Public Economics and Public Finance are two Different Streams, though they partly Overlap

Wherever and whoever is required to deal with money and its broader forms like bank accounts, actionable claims, credits and payables, is actually dealing with finance. Finance is thus primarily about managing resources that are made of money or exist in monetary terms. Though a lot of managers, scribes and public executives surprisingly and erroneously seem to think it is economics, it is not so. Economics is not primarily about money, but rather about why, when and how people deal with economic goods, to make their lives better off.

A few thousand years back, humanity was largely dependent upon agriculture, most people grew their own food, which they consumed and bartered for other goods that they could not produce themselves. Money was not ubiquitous and largely consisted of precious metals which people collected and preserved as wealth, and occasionally exchanged for other goods.

All this changed drastically once money was introduced in our lives. Like any other asset, money is a store of value, so people want to have more and more of it. However, the reason why people want to have it even more than any other asset is because it is a medium of exchange. For a very long time, gold was the most important form of money. Even after modern currencies like Pound and Dollar were introduced, it was still gold which ruled, because these currencies were nothing but a promise to pay the holder a certain amount of gold or its equivalent.

In other words, these currencies were linked with gold and the monetary systems were tuned to a ‘gold standard’.

The nature of money underwent a major metamorphosis in the second half of twentieth century, when the United States broke the link between the US dollar, which was the primary international currency at that time and gold. The result was a fiat currency, which did promise to pay, but not in terms of gold, and thus ceased to have any intrinsic value.

Managing money became important from the day money became available, irrespective of whether it was in the nature of gold or any other medium. For instance, in primitive societies, they were other units of wealth that were also used as a medium of exchange, like cattle, horses, harvest, grains or semi-precious stones. The art of managing money gradually evolved in what we call ‘finance’ today. It involves keeping track of how much money we have received, how much more of it is receivable, from whom and when, and similarly, how much of it has been paid or is payable.

The core complexity of finance arises from the ability of money to generate a return by getting employed in a productive activity like business. These returns, which can be in the form of interest or dividend or capital appreciation, have now come to occupy the central stage in modern economies that are overflowing with monetary capital. Today, most resourceful people earn not from their labor, but from the efficient utilization of their monetary resources. These same resources are also called financial resources, and the accounts which represent the complete details about them are some of the most important records in the modern world.

Today, finance is an industry in itself, where enterprises like Banks attempt to collect money from different resources at a cheaper rate of interest, and then lend it to businesses at a higher rate, after taking into account their credibility and the risk of nonpayment. Risk has therefore become an important constituent of the financial universe.

Economics, on the other hand, can be understood as the study of how people deal with economic goods. It focuses on how they go about consuming, producing, exchanging and transferring such goods. The term economic goods include both goods and services, and also includes intangible properties and rights. The word ‘good’ denotes that it makes our life better off when it becomes available. As a rule, it relates to goods that are either made or collected by human effort and thus does not include environmental goods like air, rivers, sea or mountains, unless of course, we are referring to some special legal rights in respect of them that has been granted by the society to particular persons.

In economics, the emphasis is on economic goods and not just money. Money is usually a medium of exchange and a store of value, hence can be a measuring unit of economic goods, but the focus in economics is not on accounting, but on actual economic actions like consumption, production, exchange and so on.

It is surprising as to how often public managers, including those who decide our economic destiny, confuse between economics and finance. At times, you might even get an impression that some of the economists are also beginning to get mixed up between the two, but then one must not forget that economics or human behavior is very difficult to quantify, or observe in objective terms. Given our limited tools, we usually resort to use of money as a measure for economic activities. This is a limitation with which we need to live, and yet, it is essential that we do not forget the basic difference between these two streams, both of which deal with money, but in a very different way.

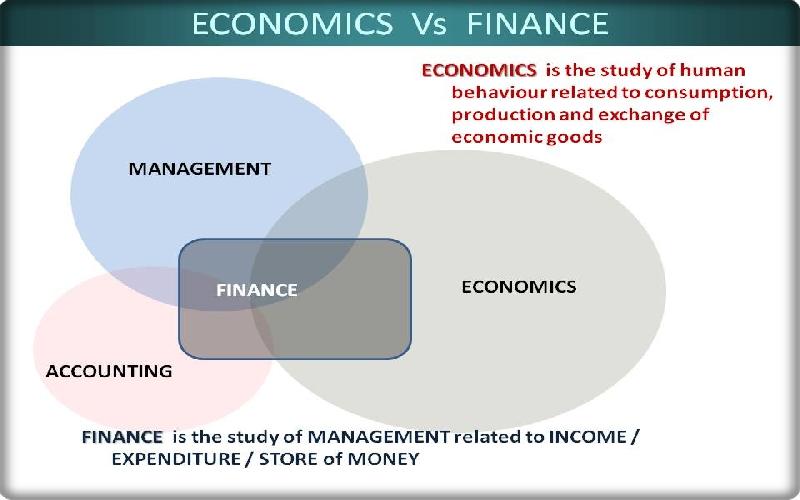

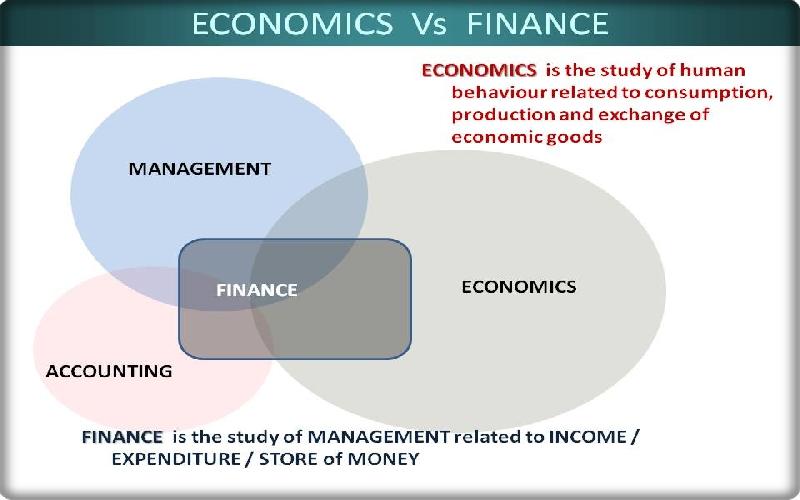

While economics refers to human behavior regarding consumption, production and exchange of goods, finance revolves around management of monetary resources. To manage money, one often needs to take the same decisions, regarding production, consumption and exchange, which are the hallmark of economics, and yet, the two streams still differ, because while an economic decision is undertaken with the intention of maximizing one’s welfare, the financial decision is undertaken to ensure the best use of financial resources. As one can see, the two are very closely connected, particularly in cases of artificial entities like a firm, which do not have any real existence and hence neither consumer nor want any welfare, and which come into existence with the sole objective of maximizing monetary returns on capital.

The difference between economics and finance lies primarily in the emphasis on humans in economics and the lack of such focus in finance. In case of firms or companies, which are in the nature of legal fiction and do not actually exist in real life, the human component is missing. Unlike a human being, a company, which exists only for production or exchange of goods, does not and cannot consume an economic good. The goods that it internalizes for its objective of business are not in the nature of consumption, but in the nature of raw material that are transformed by it into another product. The corporate accounts and the corporate economics therefore create the maximum overlap that we can witness between these two streams.

Public Finance is a term that relates to how Government and other public institutions like local authorities and certain autonomous agencies financed by the public, collect and spend resources. Like a corporate entity, governments are also not human. Hence, they are also not supposed to consume. The resources that they exhaust are supposed to be an input for their public function output, most of which are in the nature of public goods or public services. The most important public finance exercise is the annual budget, whereby the legislature or the authority competent for this purpose decides how much money it plans to collect from different sources, and how it wishes to spend it during the coming year. Thus, the primary thrust of public finance is the efficient management of monetary resources of the Government.

Public Economics, on the other hand, relates to a much broader stream, including an enquiry to identify options for collecting and spending resources by the Government that will maximum the welfare of the citizens. An example could be deciding which taxes are to be levied and at what rate, so as to ensure that their consequent least interference with the normal economic choices of the consumers and producers are minimized. Similarly, another example of a public economics challenge could be to design a subsidy that will be most effective and least distortive for the economy. Public economics must analyze every proposed government intervention or regulation to identify its negative or positive impact on the economic choices of the individuals and on the economy as a whole.

As is the case of economics and finance, public finance and public economics also overlap significantly, but they still remain two distinct streams of academics, with very different focus.

This article highlights the key differences between Financial Accounting and Management Accounting..

If anybody ever tells you that accounting is too simple, just ask him to tell you the difference between capital and current expenditure. In its full complexity, the question is and will always remain worth an argument.

Managerial economics helps to develop leadership qualities which are necessary for every business. It helps in effective decision making thereby profiting the company.