Cost of Foregone Opportunities is a Key Factor in Economic Decision Making

Economics is all about how decisions related to economic goods are taken in the real world. Opportunity cost is crucial in such decision making, and constitutes the actual cost that is relevant in economics. Being different from financial costs, it can sometimes be a challenge to determine it, especially when policy decisions need to be taken by the state for benefit of its citizens.

The concept of cost is extremely crucial in economics, since the decision to undertake or not to undertake an economic action often depends upon it. These decisions are often a consequence of the interaction of value, price and cost. When the value of a good is more than its cost, procuring or consuming such a good will make an individual better off, so he will go for buying it. Similarly when the price of a good is more than its cost, a supplier will supply it and want to supply more of it.

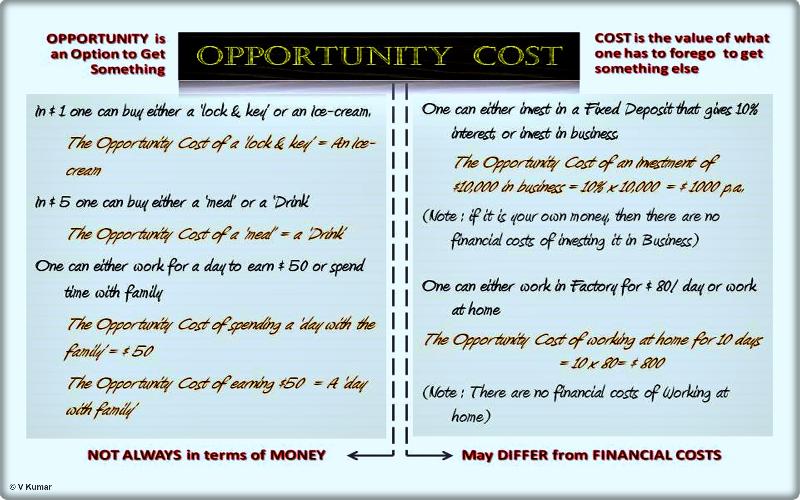

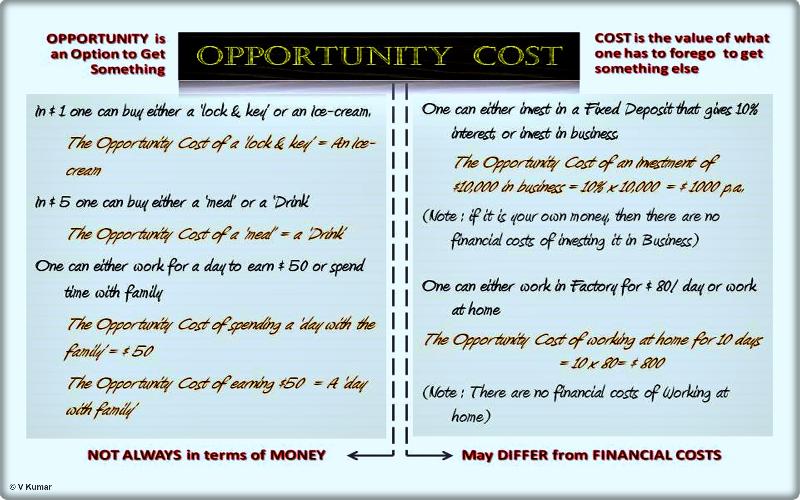

However, one must be very clear about what we mean by the term ‘cost’ in economics, since it is not always in terms of money. Recalling the differences between economics and finance could be helpful in this regard. In economics, it is opportunity cost that is taken into account instead of the financial costs.

The word ‘opportunity’ refers to an option of getting something or doing something by which one would become better off.

For instance, a worker has an opportunity to work for a day and thereby earn certain money. An individual having some money has an opportunity to buy something with it. However, these opportunities must be real and available and not just theoretical or a matter of presumption. Thus, a worker who is unemployed and is unlikely to get work does not have the opportunity to earn money. Similarly, an individual who has money in a currency that is not accepted by the market does not have an opportunity to buy something.

The word cost is used in economics to indicate what one needs to forego to get something else. Thus, an individual wishing to buy something in the market must pay its price, which then becomes the cost of buying that good. However, the cost need not always be in monetary terms. In a barter transaction if one exchanges five apples for a fish, the cost of getting a fish is five apples and the cost of getting five apples is a fish.

The word opportunity cost extends the concept of cost to include that which one had an opportunity to get or enjoy and which one has to forego to get something else. For instance, consider an individual who has a dollar and wants to buy a lock and key, as well as an ice cream, but can buy only one of them, since each costs a dollar. If he buys an ice cream, he must give up the opportunity to buy the lock and key, and on the other hand, if he buys a lock and key, he must forego the opportunity to buy the ice cream. The two items become an opportunity cost for each other.

In the same case, if he did not need the lock and key, then his opportunities are limited to buying an ice cream or retaining the dollar for use sometime later, and the likelihood is that if he values ice cream more than the dollar he will go for it. In this case, the opportunity cost of buying ice cream is only one dollar, whereas in the earlier scenario where he also wanted to buy a lock and key, it could be more if the value of lock and key, which he must forego to buy an ice cream, is more than a dollar for him.

Opportunity cost can be somewhat subjective, depending upon the circumstances of an individual and his needs and preferences.

Opportunity cost is important when investment decisions are made. For instance, consider an individual who has $10,000 that he can invest either in a debt instrument that will give him a fixed rate of return, or in a business as equity shares listed in a stock exchange. If the prevailing interest rate in fully secured debt with zero risk is 10%, then the opportunity cost of investing in equity would be the 10% returns from investing in debt that must be foregone. On the other hand, the opportunity cost of investing in debt would be the probable returns from investing in equity. While estimating the probable rate of return from equity, the risk element will need to be quantified and taken into account.

So a prudent economic decision would be one where the gains of investing are more than its opportunity costs. Investment in equity would be reasonable only if probable gains are expected to be more than the opportunity costs of 10%, and if the eventual returns are less than 10%, the difference can be considered a loss.

Interestingly, even if the returns from both investments are equal, it may not be prudent to invest in the equity shares since according to the principle of diminishing utility, the value of money lost in a negative scenario is likely to be more than equal amount of gains in the positive scenario, a principle that also forms the basis of economics of insurance.

Working to earn money does not require any money to be paid, and in that sense there are no financial costs of working. However, in economics, if anything valuable has to be foregone to get something else, it is a cost. So, if an individual, who greatly values to spend time with the family, has an opportunity to either earn $50 by working for a day or spend that time with his family, the opportunity cost of working for a day is the foregone opportunity of spending time with the family. On the other hand, the opportunity costs of spending time with the family would be $50 for every such day.

In real life, the decisions to balance work and leisure are generally undertaken on the basis of their respective opportunity costs. Both money are leisure acquire greater value when they are available in scarcity, so if a person is already employed for working 8 hours every day and he gets an opportunity to work for more hours, there is a good likelihood that he may agree to forego his scarce leisure time only if he is paid a higher amount of wages for the extra hours of work. This happens because the opportunity cost of working for additional hours is higher than the opportunity cost of working for regular hours.

As can be seen in the preceding example, working for money does not have any financial costs, since no money is to be paid to anybody for this purpose. Yet, significant costs are there, which affect one’s decisions. This also highlights the differences between economics and finance.

There can be occasions where opportunity cost is the same as financial cost. For instance, a company is only a legal fiction and does not actually exist in the real world. It does not consume anything, but is usually established for the sole purpose of maximizing returns on investments. For a company, all opportunities are measurable only in terms of monetary profits which generally coincide with their respective financial values.

Significance of Opportunity Costs for Governments & Policy Decisions

Since Governments aim to maximize the welfare of the citizens, and since its scarce resources are sought for different public works benefitting different stakeholders, opportunity costs assume immense significance therein. For instance, there may be a need for three different public projects like roads, schools and hospitals, but available resources may be enough for only one of them. In such situations, the Cost benefit analysis, taking into account the opportunity costs of foregoing the benefit of other projects must be taken into account to arrive at a policy decision on which project should be undertaken first.

Opportunity cost is one of the most fundamental concepts in economic thinking, and it is not possible to proceed in economics unless one fully comprehends and applies it.

In the Philippines, there’s a popular business phrase that everybody has heard of. Just as when you hear “Open-minded ka ba?” (Are you open minded?), for sure you’ll know it’s pertaining to an invitation of joining a networking business..

The performance appraisal is the process of comparing an employee's performance with already established standards and providing them the feedback about their performance so that they can easily improve their performance..

If you are an entrepreneur, it is important that you create your online presence by having accounts at various social media platforms. They not only let you promote your products or services but also connect you with your customers.