Asset bubbles: How do they develop?

Asset bubbles are unsustainable rapid rise in prices of assets which are primarily a result of expectations about the future price rise of assets. The asset bubble 'busts' are an even more rapid fall in prices, which can seriously damage investors and economy and lead to crisis similar to one we are facing at a global scale right now.

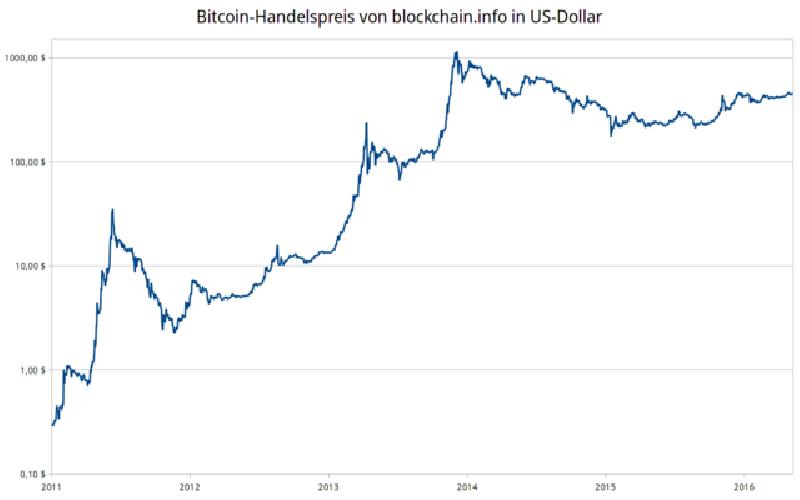

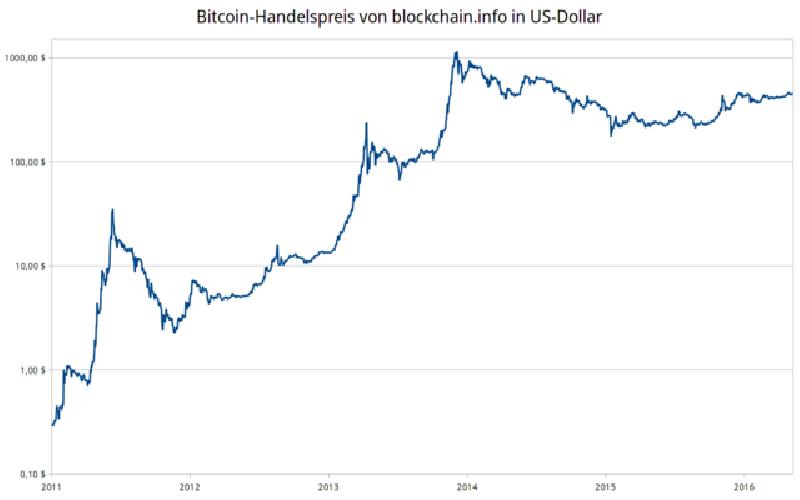

As the world fascinatingly witness the phenomenal rise in the price of bitcoins, and tries to understand the economics behind their spectacular demand, and as we complete a full decade of what was one of the biggest asset bubble led financial crisis of our times, it is time to recall and remember the asset dynamics that leads to the creation of asset bubbles.

Asset bubbles

Asset bubbles mean rapid rise in the prices of assets like equity shares, land, houses, gold, metal and commodities, without any obvious reason that can explain such price rise. The asset bubbles are inherently unsustainable, and they end in the form of sudden "busts" - an even more rapid fall in prices. The investors holding those assets at the time of bust have to suffer significant losses.

The recent global economic crisis has its origin in asset bubbles created in some countries especially the United States. Asset bubbles are the latest challenge for economists, policy makers and central bankers. The rapid fall in asset prices can upset the whole economy. In the recent sub-prime crisis, the fall in housing prices was one of the main reasons for defaults in loan payments, which in turn caused the bankruptcy of many financial institutions and even threatened the life of Freddy Mac and Fanny Mae.

Price of an Asset

The price of an asset should rationally represent the returns from that asset in future.

In case of equity shares, these returns come in the form of dividends as well as the expected future rise in prices of that share. In the case of houses, the returns consist of rental value of that house. In case of gold and other commodities, the asset-returns are the rise in prices of that metal or commodity that is expected in future months and years.

Thus, the most important components of asset prices are expectations. In fact, asset prices are a case of 'self -fulfilling prophecies'. When people expect price of a share to rise next week, they buy it today to get the profit. This increases the demand of that share today, and as a result, the price rises today itself (instead of next week). It also means that even when there is no other reason for asset price rise, the mere existence of an expectation of a future price rise can still be enough to raise prices.

Asset Bubbles as a Consequence of Expectation based Asset Prices

Another aspect of expectations based asset prices is that when prices rise, the expectations of future price rise also increase. As a result, prices rise even higher. This can easily become a vicious cycle, where prices rise exponentially for a short time, leading to a "bubble" like phenomenon, which is not sustainable and soon 'busts' leaving investors high and dry.

The 'expectations' of asset prices are not perfectly rational. Instead they are usually based on some heuristics or thumb rules like past trend of price rise, average rise over last few months or years, forecasts etc. These expectations can also change very quickly in the presence of adverse news, a phenomenon called "announcement effects". Thus, even a small news item like that of a crisis in Dubai can affect the global stock prices throughout the world, even when there is no relationship between Dubai real estate prices and other sectors of economy.

The whole world is still struggling with asset bubbles, and trying to find ways of preventing the damage that asset bubble busts can lead to. One of ways that we can contribute to this objective is by understanding how they happen and improving global consciousness about them.

Creating a savings account in the bank of your choice is the most common type of investment. It seems you have your own account too but this article serves just as a refresher..

The Internal Revenue Code prescribes limitations on the early withdrawal of Roth IRA investments, which must be understood at the time one opts for this plan. Apparently, these limitations are a disincentive against these plans.

Complex systems of the modern world require more than simple solutions. There is often a need to elaborate upon the context in totality, identify point that can be potentially leveraged to bring about long term changes, and find ways and means to manipulate the system into delivering the desired long term results.