Positive effects of demonetization

The main aim behind Demonetization was to introduce a parallel economy in the country. And this aspect came with several advantages & disadvantages. We all know that No gain can come without pain. We all know the pain that we experienced during demonetization now lets see some gains.

Positives of Demonetization

The debate on whether Indian PM Narendra Modi has taken the right step towards fighting black money and corruption by demonetizing Rs 500 and Rs 1000 notes still remains unresolved. Although the Modi government has claimed that over 93% of people have backed PM Modi's move of demonetiztion, many have raised questions on the survey as it was taken from the Narendra Modi app. While this decision has undoubtedly created inconvenience for the people of India, no one sees that fact that this decision can single-handedly change the India's fortunes.

The Plan of Demonetization

It seems to be clear that the decision of demonetization took place with a lot of planning. On the very first day when PM Modi was sworn in, he created an SIT for black money. Then he proposed Jan Dhan Yojana with an intention of opening accounts, especially in the rural areas. After few months of aggressive marketing, government came forward with an idea of opening a special window, till 30th Sept, that would allow an individual to deposit black money by paying some tax.

And then the Modi government came forward with the idea of demonetization. This way he made sure that people living in the rural areas had enough time to deposit money in the accounts opened through Jan Dhan Yojana. At the same time, he made sure that people did not raise finger accusing the government of treachery.

The Immediate Effect

Banks were flooded with cash, infact the inflow was so strong that banks actually had to lower their interest rates by a relative huge percentage in a matter of days. This was the first and foremost immediate effect of the demonetization. In a matter of 18 days, banks across India have become richer by Rs 6 lakh crore. Over and above banks, PM Modi's pet project, Jan Dhan Yojana also benefited a great deal. If reports are believed, accounts under Jan Dhan Yojana have witnessed a surge of Rs 64,250 crores. Among all the banks, SBI has received the maximum amount of Rs 1.15 lakh crore in deposits.

ICICI Bank and HDFC Bank were the first ones to slash interest rates by 0.25% respectively. Canara Bank and United Bank of India soon followed suit by 0.25% and 1%, respectively. Yesterday, SBI slashed interest rates to the extent of 1.9% among different term deposits. These array of interest rates simply points towards one thing - slashing of lending rates, which will ultimately bolster manufacturing sector (Small and Medium Scale) resulting in economic growth.

Black Money off Real Estate

Although no vivid figures have come out yet but experts have quoted that with demonetization, India's real estate market is expected to take a hit of Rs 8 lakh crore, meaning that average property prices across India will come down by 30% in a matter of a year. Cities like Mumbai, Bangalore and Gurgaon are expected to suffer the most as these cities are a home to maximum unsold units.

Although builders will face huge problems as they will not be in a position to yield maximum value from customers, customers on the other hand will witness transparency in the system. This will eliminate fraud and will lead to white money transactions.

Boon in Disguise for E-Commerce

Call it a boon in disguise but demonetization can actually help India's economy to become digital. With RBI giving licenses for payment banks last year, payment sites like Paytm, Airtel Money, Ola Money, Jio Money will leave no stone un-turned to leverage on the government's decision. In fact, Paytm has already started churning Rs 120 crore a day. In a matter of 12 days, Paytm has witnessed 7 million transactions, thus, helping the company to achieve its annual target of $5 billion in Gross Merchandise Value (GMV). These figures itself tell us the gravity of demonetization.

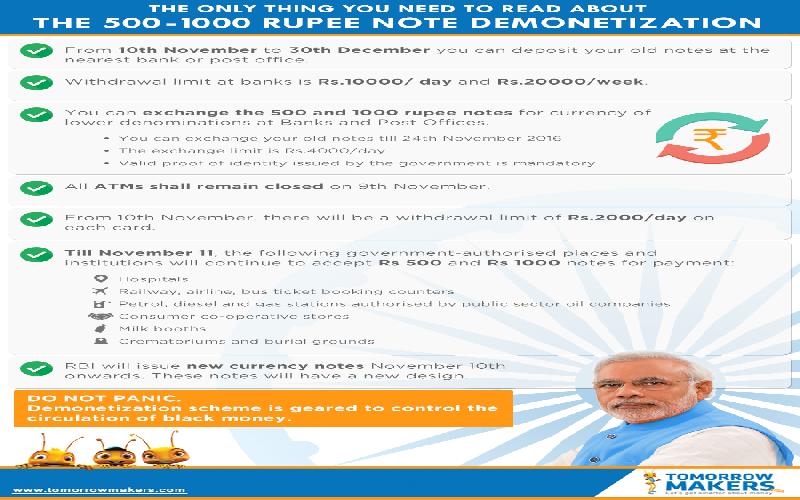

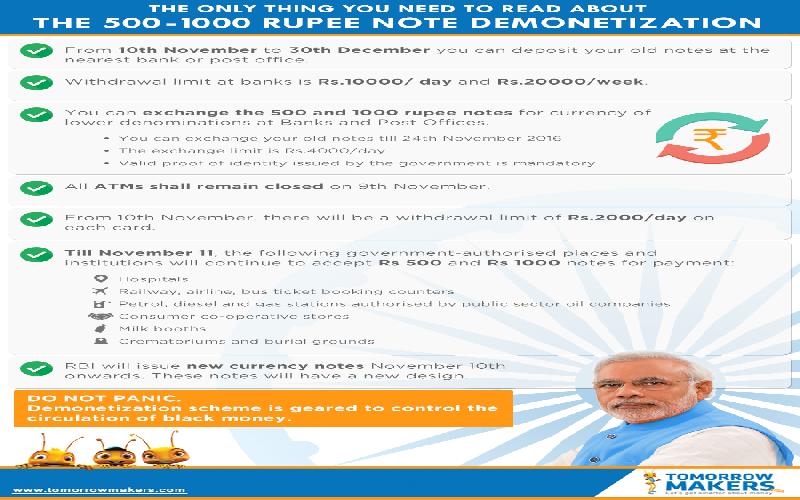

Apart from the economic effects mentioned above, demonetization was also brought on the table to eradicate terrorist funding, hawala, fake money and corruption across India. The government has tried to made sure that ample time is given to the people of India to exchange notes. They have also tried to strike a balance between taking money off streets and infusing money in the banks simultaneously. Such a bold step, if not praise worthy, at least shows how serious the government is when it comes to tackling black money.