Economic crisis: lack of business ethics

Public memory is awfully short, and one of the reasons why financial crisis tend to recur as soon as the horrifying memories of the last crisis have died down. As we complete a decade of what was one of the worst and most wide spread financial crisis of last century, perhaps it is time to remind ourselves of the man-made follies that led to it, and try to ensure that they are repeated in near future.

Human Civilization has survived till this date on the basis of our faithful adherence to certain basic principles of ethics, morality and social values. The latest crisis shows how market driven profit greediness can not only erode those values, it can also lead to severe crisis for all of us, not just in the economic arena but elsewhere too.

Business Ethics and its Meaning

Ethics is nothing but traditional wisdom, and when this wisdom that we have accumulated over many centuries of human experience is given a skip, then disaster invariably arrives in some form or the other, be it business or politics. The current economic crisis is another example of the same folly.

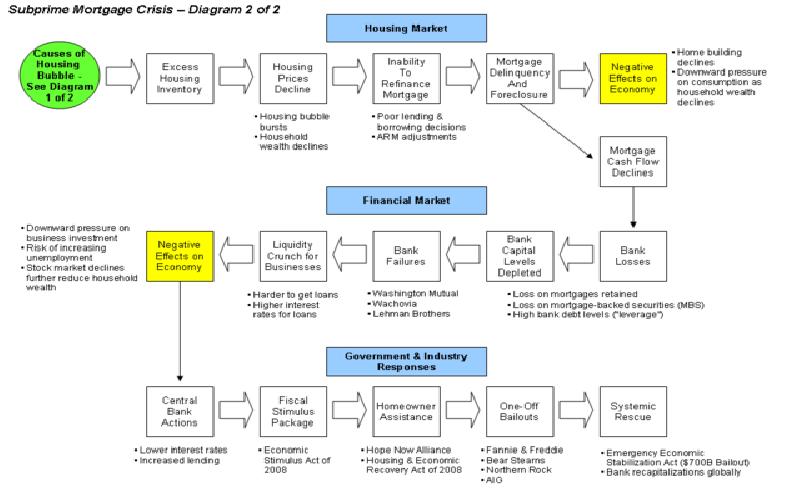

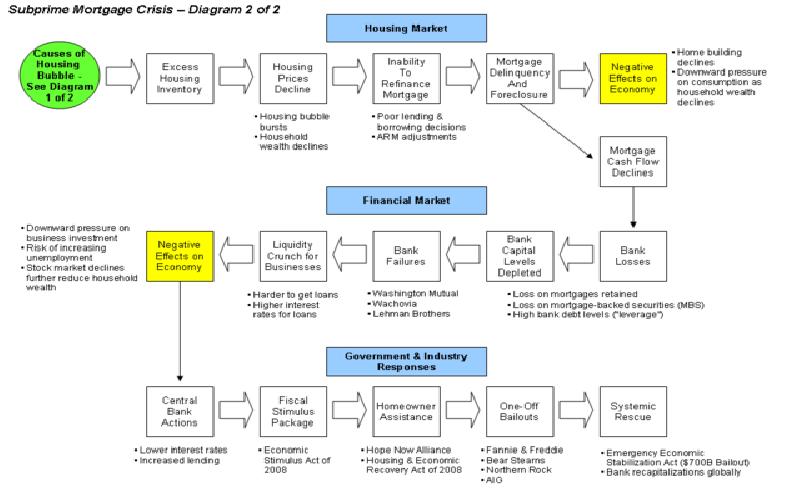

Ethics suggest expertise, hard work and enterprise, not greed and short cuts. Unfortunately, innovative mortgage financing during the real asset bubble became an instrument for rising turnover and profits for certain financiers who lost themselves to greed. Their greed allowed the already bursting real estate price escalation to grow into a big bubble. As happens with all asset bubbles, initially, for a few years, it seemed to be to be everlasting, and its resultant euphoria helped in preventing the side effects of that huge trade deficit that United States had been facing now for a few years.

However, a bubble cannot last forever, and when it finally breaks down, it brings with it disaster and destruction.

Real estate is not the only bubble that hit the globe during the last few years. The rise of crude prices to over three times in less than eighteen months is probably the best example as to how greed and speculation had replaced entrepreneurship and production as the dominating forces of global business culture. Then there were rising stock markets and rising commodity prices. In the wake of that false wealth effect that resulted from rise of all asset valuations, there was high consumerism that sustained the global economy for a while, but in the end only made everything much worse.

Fortunately, things have still not gone out of hand. While the governments across the world juggle with the tax payer's money to contain the damage and lessen the pain, there are certain lessons in this disaster too that we all need to learn. It is particularly true for those whom we trust with our money and who take decisions on our behalf regarding its use, be it the managers of those corporations in whom we have invested or the state regulators whom we trust with our mandate. We need to prevent greedy speculation in the name of business - not because there is anything morally or ethically wrong in it, but because when such greedy businessmen are done with their greed, we - the taxpayers, and common citizens, are left to clean the mess.

And lest we forget, the economic crisis is not the only disaster facing us. Lack of ethics can lead us to other disasters too!

Management by objectives -MBO is a practice in which the employees take part in goal setting process which enables them to be aligned with organization and in the attainment of their goals. MBO is aimed at increasing organizational performance by setting the goals of managers and subordinates together providing motivation and commitment while ensuring better communication between the superiors and the subordinates.

Network marketing also known as MLM, have been a major home business many take part in, however to success in it there are several attributes, ideas and means you must adopt and practice..

Inflation makes our money lose value. It is the process of increasing the price of goods.