Income statement For Non-Accounting Professionals

Income statement is one of the five (as per U.S. GAAP) main financial statements, the other four financial statements are: Balance Sheet, Statement of Cash Flows, Statement of Comprehensive Income and Statement of Changes in Stockholder’s Equity.

Income statement goes by different other names as well: profit and loss statement – P&L, revenue statement, earnings statement, operating statement, statement of operations and statement of financial performance. Regardless of its names, the sole objective of preparing income statement is to measure all revenues versus business expenses for a given time period in order to determine the financial health of a business, the performance and the ability to efficiently keep going with future operations.

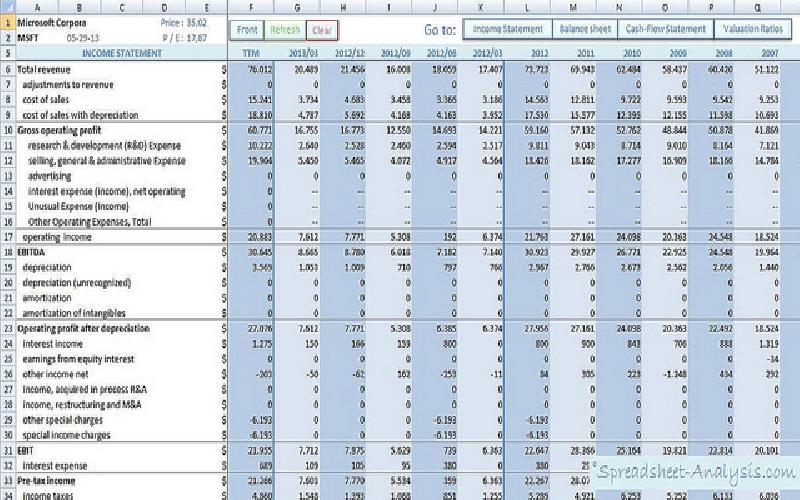

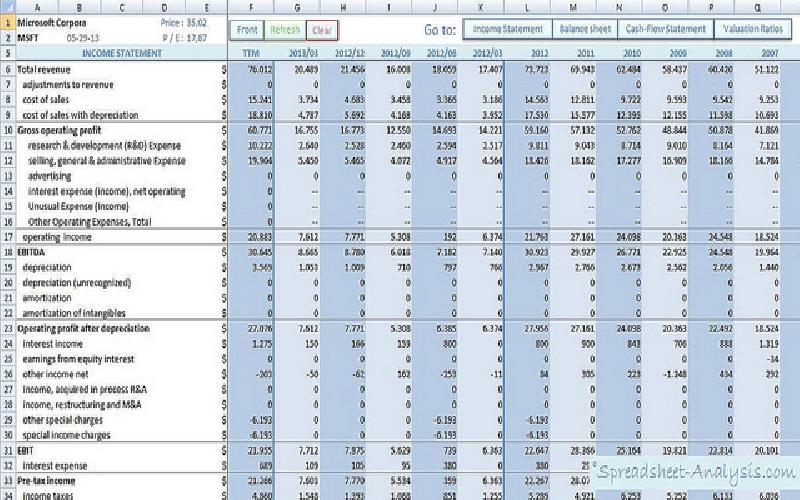

Before we discuss any further, let’s take a quick glance at the format of an income statement outlining its major components. Though the income statement seems to be straight forward listing revenues at the top, expenses in the middle and the profit or loss being shown at the bottom, but its format varies from company to company or according to the complexity of the business activities. However, most companies have the following elements in the income statement.

The format of an Income statement:

Sales or Revenues

-Cost of Sales

=Gross profit

-Other expenses and losses

+Other revenues and gains

-Financial charges

=Profit before tax

-income tax

=Net Profit

Revenues and Gains

Expenses and Losses

Income statement shows the profit or loss sustained by a company during a particular period including all the items of income and expenses. Net income or loss represents the difference between a company's revenues and expenses during an accounting period.

A company's net income for an accounting period is measured as follows: Net income = Revenues - Expenses + Gains - Losses.

To put it simply, if the net amount of revenues and gains minus expenses and losses is positive, the bottom line of the income statement indicates as net income, while the net amount is negative it's a net loss. Thus, the difference between total revenues and total expenses in accounting period is what determines to be either profit or loss. The former case indicates revenues to be greater than expenses, while in case of latter expenses are in excess of revenues.

It must be noted that the income statement is prepared using the accrual method of accounting while applying it to all the historical transactions.

At this stage, it is appropriate to mention that there are two primary methods of accounting, Cash basis of accounting and accrual basis of accounting. Both methods are acceptable though, but the accruals basis of accounting is mostly used as it provides a better picture of company’s profit during a specific period of time.

The key items that are listed on the income statement are: Revenues, expenses, gains and losses and the accounts that are used to record revenues, expense, gains or losses are regarded as temporary accounts, as they are closed to a permanent account –retained earnings. In contrast to a balance sheet, an income statement depicts what happened to a business over a month, quarter or a year including the results of a company’s operations during the period and so it is like a moving picture.

Cash Flow Statement is beneficial as it helps in keeping record of various cash investments right from the beginning till the end. It is an important financial tool that helps in making various financial forecasts.

Computer programming is one of the most advantageous fields. It provides a wide range of good prospects in the career advancement.

Accounting is regarded as a Business Language. It is of great essence for a business to establish a good accounting system in order to keep track of every single business transaction or a business event and determine the profitability by dint of income statement and the status of a business with the help of balance sheet..