Health Care Insurance Premiums: Who should Pay it?

Healthcare Insurance Premiums pose a financing dilemma for the policy makers, with no simple answers. The challenge of healthcare financing is a difficult one, and health insurance continues to remain a somewhat imperfect solution. Rising premiums continue to haunt the employers and pose risk for growth of employment and wages. It is problem that needs to be addressed.

Health Economics has some of the most politically sensitive debates to offer. One of the perennial ones is about who should pay for the healthcare. The state must have a role – that we all agree, but what we often do not is the all encompassing power of the state to monopolize it altogether. Then the businesses must also bear the cost for their employees, as part of broader social security framework, but is that good economics. This, in essence, is the million dollar question that we need to think about!

The Problem of Rising Healthcare Insurance Premiums

The reason we are into this debate is the fact that healthcare insurance premiums continue to rise. The US National Healthcare expenditure has been rising between 3 to 10% every year since 2001, without corresponding improvements in health outcomes.

This is what the White House Economic Advisors had to say about the impact of such persistence in insurance premiums:

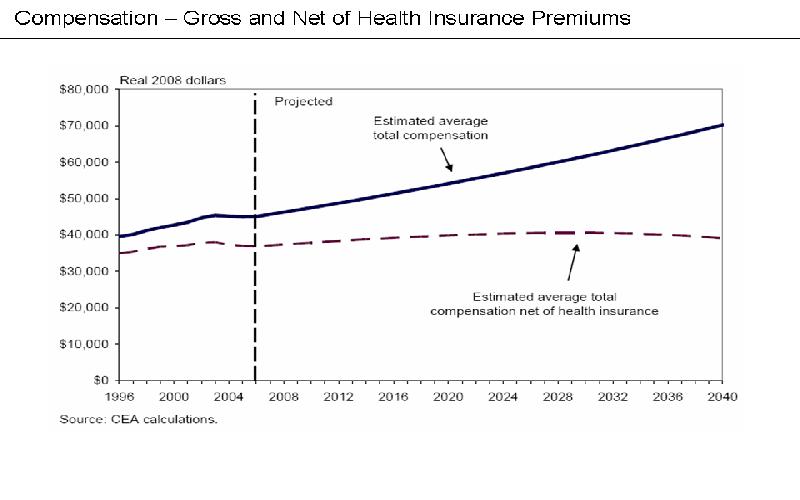

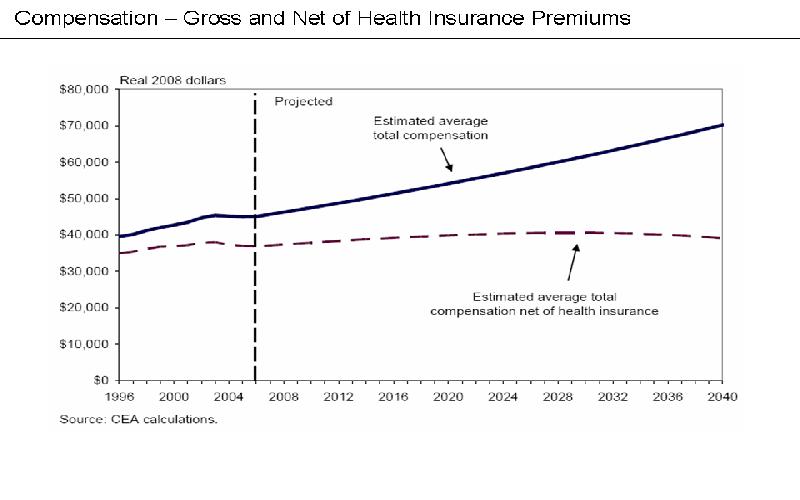

“Employers think about the total compensation cost of employees and that calculation considers what they pay in health insurance premiums, in addition to salaries and wages. Since insurance premiums continue to grow rapidly, this cost is increasingly replacing other forms of compensation. The Council of Economic Advisors predicts that eventually wages will actually be reduced in real (inflation-adjusted) terms as the increase in insurance premiums will require reductions in non-insurance compensation. Health insurance premiums are thus a cause of salary and wage growth stagnation for much of the population in the U.S.”

(Source: White House CEA Report, 2009 )

It has been predicted that an ever-rising proportion of compensation payable by employers to their employees will ultimately be taken up by the employer’s healthcare insurance premiums, thereby eating up in the actual wages (net of insurance premiums) that employees get for their work. It means more wage burden on employers, and lesser wages for employees. Clearly a lose-lose situation for all. The saddest part is that it still not expected to translate into any clear benefits, as life expectancy for corresponding healthcare expenditure per capita in United States continue to lag behind the rest of the developed world.

Who should bear the cost of Health Care & Why?

From an economic perspective, there are certain principles that must be kept in mind, while dealing with this issue.

Health is a private good .... but also a merit good

The cost of health care insurance should be directly borne by the people themselves, and the state should step in to help those who are unable to help themselves. That is the only way to keep the costs reasonable. Any other system is bound to fail.

Health care is a private responsibility and its cost should be paid by the individual. However, there is a catch - sickness can be a catastrophic event, which may never happen in case of most people and families, but when it does, the results can be very destructive, as much in terms of financial well being, as in terms of physical pain and health.

Risk Pooling can take care of Health Emergencies

It is to take care of this possibility of catastrophe, that 'insurance' becomes desirable. Thus the people need to come together, with the aid of the state, or without it, to pool the risk of illness in their families and lives, and take care of it by pooling the cost of tackling those risks by way of premium contributions. It is a necessary and almost inevitable policy for which there does not exist any other viable alternative.

The issue then boils down to a simple question - "who should pay the premium for this insurance?"

Financing of Healthcare Insurance Premiums: Different Options & their Consequences

The cost of health premiums can be potentially borne by three candidates - the state, the employer and the individual. Before we go any further, it would be relevant to note one very pertinent fact. The state and the companies don't have any real existence devoid of the individuals whom they represent.

The 'state' effectively means the citizens or the taxpayers, who will have to bear all of its expenses including any insurance that it may have to pay for. The employer companies will include the cost of this insurance into the price of their products, as that is the only way they can continue to bear that cost. This price will have to be borne by the consumers of their products, and if this price rises too much, the consumers may shun that product, leading to closure of the employer company, and as the employees shift to another company, the cycle may again get repeated. Or, the consumer may happily bear the cost, and the employer business may continue to pay the health insurance bills. Unfortunately, that is not exactly happening!

Impact on Businesses

More businesses are becoming bankrupt today in US because of the rising costs of health care insurance, than any other single reason. Clearly, putting the cost of health care on businesses, is adversely effecting the business health of US.

The individual is going to bear the cost of health care any way. Only alteration that can be made is in deciding as to who that individual would be. One also needs to understand that leaving it on businesses to pay will not ensure any equity, as the worst affected, the unemployed, and those employed in the unorganized sector will become the worst hit, as they are today - without any insurance.

The Moral Hoazard Problem

Another danger of shifting the responsibility of health care costs from the consumer to another entity, is what is referred to by the economists as 'moral hazard', the lack of interest on the part of the individual to keep the costs reasonable. This becomes particularly dangerous in case of medical care which can always get supplier driven, because of the inherent inefficiencies of health care market.

health economics, cost of healthcare, business costs of healthcare, should business pay for healthcare insurance, healthcare insurance, who should pay for healthcare, who should pay for medical insurance, medical insurance, health insurance, pros and cons of employer healthcare insurance, healthcare costs, efficient healthcare services, problems in healthcare costs, why medical insurance, cost of health premiums, health consumption, healthcare market

Health care insurance has to be paid by the individuals, and wherever they cannot pay it, the state should play a role, but it will have to ensure that the efficiency of the system is not compromised.

Trading on forex markets is by no means an easy task. Apart from being speculative and intuitive, traders need to be focused, disciplined and cautious about different forex scenarios.

Entrepreneurs need to possess a particular skill-set to become successful in their chosen field. In this article, we will be discussing some of the most important ones, with examples.

A budget in simple terms is a plan for allocating resources and specifying how resources will be allocated or spent during a particular period. It shows the amount of money that is available for, required for, or assigned to a particular purpose or period of time. .