What is accrual concept in financial accounting?

Below article defines accrual concept in Financial Accounting. It also speaks about the importance of accrual basis accounting method while discussing in a little bit detail.

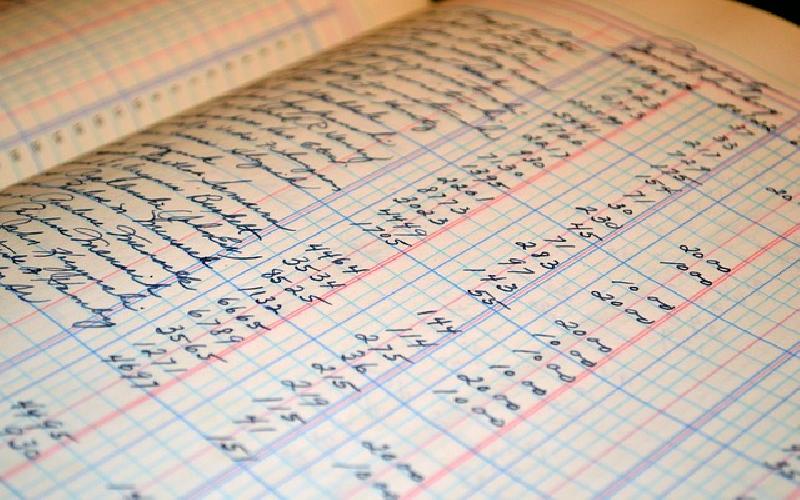

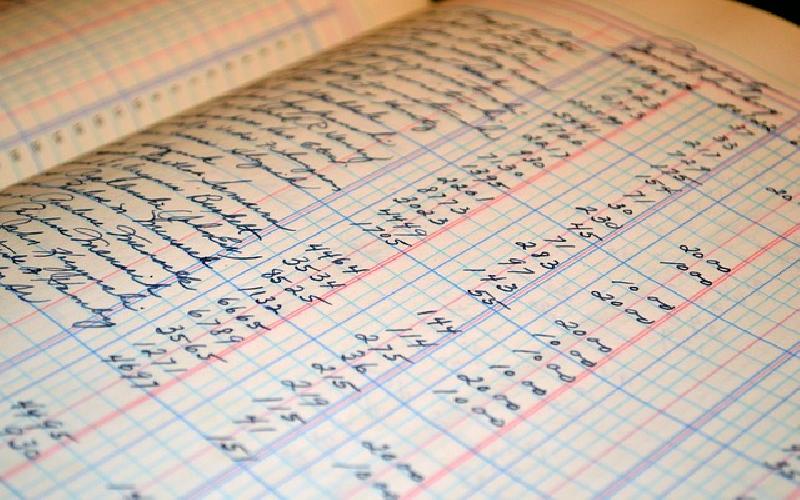

The accrual concept in accounting means that expenses and revenues are recorded in the period they occur, whether or not cash is involved. The benefit of the accrual approach is that financial statements reflect all the expenses associated with the reported revenues for an accounting period.

[Don't Miss: Accounting: Need and Importance]

While we are discussing the accrual concept in financial accounting, it is important to note that there are two methods of accounting, cash basis accounting method and accrual basis accounting method. The former method involves reporting income when it is received and expenses, when they are paid, whereas, in accordance with latter method the income is reported when it is earned and expenses when they are incurred. And this is what differentiates between the cash basis accounting method and the accrual basis accounting method.

The accrual basis accounting method enables to track income and expenses while it is concerned with the notion that revenue should be matched with whatever expenses or assets produce that revenue. Thus the matching principle facilitates making careful estimates against revenues that are recorded, but are not received. That’s how the accrual method of accounting aims at providing more meaningful financial information.

One of the main reasons why accrual basis accounting method is most useful is that it provides the results of operations accurately.

For example, when a business makes sales or provides services on credit basis to the customers, the financial entry that needs to be generated or made is debiting receivables and crediting revenues. So, providing required information in terms of revenues and receivables, the results are matched in an accurate manner.

Accrual basis of accounting method provides a better picture of a company. It is widely used, because it leads to produce financial statements in an accurate manner. Since the accrual basis accounting method involves recording revenues and expenses together in the same accounting period, it enables the users of financial information to evaluate the performance of a business entity accurately . As regards the cash basis method of accounting, it does not provide the accurate picture of liabilities that are incurred but not yet paid and does not provide sufficient records that are required to file for audits. Thus, accruals are a key part of the closing process of accounting and preparing financial statements. Financial statements are prepared under the accruals concept of accounting which requires that income and expense must be recognized in the same accounting period.

Creating a savings account in the bank of your choice is the most common type of investment. It seems you have your own account too but this article serves just as a refresher..

Implementing Employee retention strategies is important in any business organization that wants to get sustainable development. This article focuses on the need and importance of employee retention in an organization..

Public memory is awfully short, and one of the reasons why financial crisis tend to recur as soon as the horrifying memories of the last crisis have died down. As we complete a decade of what was one of the worst and most wide spread financial crisis of last century, perhaps it is time to remind ourselves of the man-made follies that led to it, and try to ensure that they are repeated in near future. .