What are the functions of a balance sheet?

A Balance sheet is a financial statement which shows the financial positon of a business at a particular point in time. The balance sheet serves various functions. Below article discusses the functions of the balance sheet in brief.

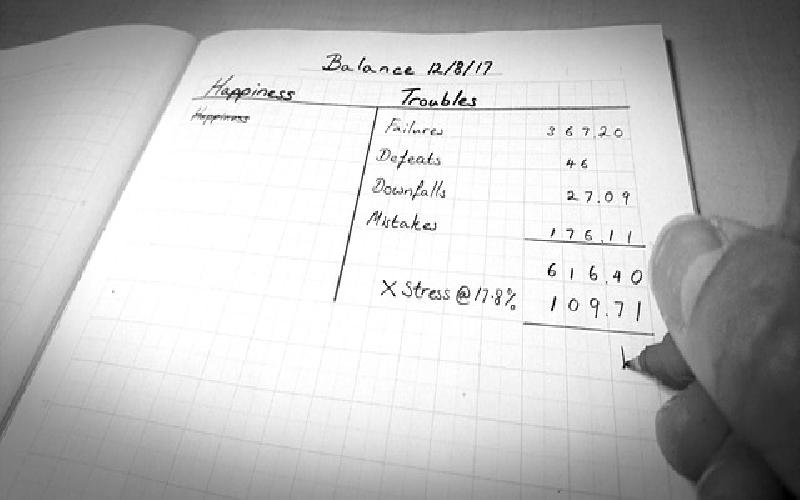

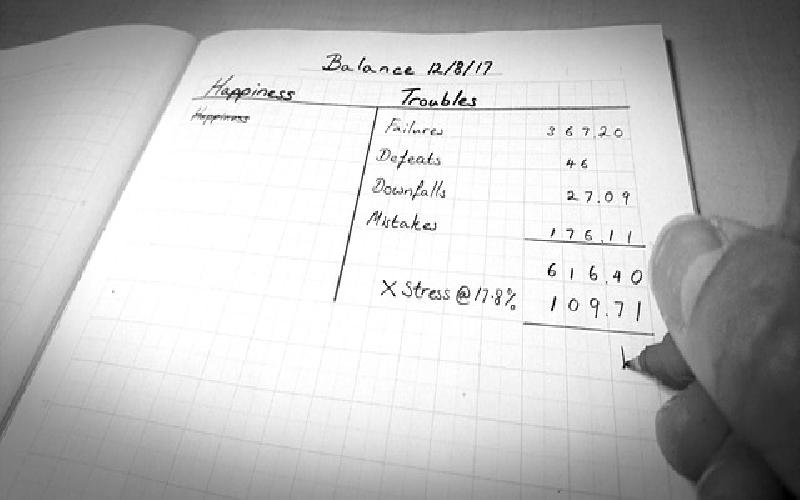

A balance sheet is a statement showing the assets and liabilities of a company or institution at a particular time. In a broader sense, it can be defined as a statement that encompasses the assets, liabilities, and capital of a business or other organization at a particular point in time, detailing the balance of income and expenditure over the preceding period. Unlike the income statement which is like a movie of the operational results over a period of time, a balance sheet is a snapshot of the financial condition of the firm on a particular date.

The reason why a balance sheet is often described as a snapshot or a photo of the company on a specific date is that it captures the financial position of the firm and reveals a company's assets, liabilities and owners' equity (net worth) having been summarized. The balance sheet, also referred to as a statement of financial position, displays what a business owns and owes, while it shows what a business is worth at one point in time.

Regardless of the size of the business, accounting is a vitally important accompaniment to a business. And an accurate accounting system is a key to many aspects of the business. What we get from the definition of accounting is that it acts as a steward to the company owners and other interested parties in a business and thus it has a custodial role to play.

As regards the balance, it does fulfill this function, as it provides a true and fair view of the state of affairs of a business firm showing the assets owned by the firm as well as the claims against them.

Another important function which is served by the balance sheet is that it provides the information about the liquidity position of the firm. At this stage, it is important to mention what liquidity is. In accounting, liquidity (or accounting liquidity) is a measure of the ability of a debtor to pay their debts as and when they fall due. It is usually expressed as a ratio or a percentage of current liabilities. Liquidity is the ability to pay short-term obligations. One important aspect which is to be noted with regard to the liquidity position of a business is that the benefits of greater liquidity are substantial. Hence, the greater will be the liquidity, the lesser will be the risk of liquidity position of the firm and vice versa. It thus this function of balance sheet is helpful for providing the information related to the liquidity position of a business with which it can be determined that whether or not assets can be converted in to cash quickly and also the security can be bought and sold without affecting the asset’s price.

While the liquidity is important for a business to thrive, Solvency is essential to staying in business. In this way, both liquidity and solvency are equally important to a business. Solvency, in finance or business, is the degree to which the current assets of an individual or entity exceed the current liabilities of that individual or entity. Solvency can also be described as the ability of a corporation to meet its long-term financial obligations and to accomplish long-term expansion and growth. A good sign of a healthy company is that it is both solvent and possesses adequate liquidity. In view of the fact that determining the solvency of the firm is necessary, the balance sheet serves this function allowing its intended users to judge the business's solvency accurately.

There are number of tasks performed by HRM in an organization. Let us look at various objectives and functions of human resource management.

If for some good reasons you are averse in taking a very risky type of investment or you do not have enough time to study and learn more about the stocks, then pooled funds is another thing you might want to consider..

Economics is all about how decisions related to economic goods are taken in the real world. Opportunity cost is crucial in such decision making, and constitutes the actual cost that is relevant in economics.