Externality and its importance in Economic Policy

Externalities are social costs and benefits that are not internalized by market price. These costs or benefits on society make the free market process inefficient, and constitute market failures, thereby justifying government intervention in markets. Governments can deal with them by taxes, subsidies or quantitative restrictions on production.

An externality is a cost or a benefit arising from the production of consumption of a good to a person other than the producer or consumer of that good. It is not internalized into the price of that good, hence called an externality.

Usually the price of a good in a free market will reflect the marginal cost of that good borne by the producer or supplier of that good, and the marginal benefit arising from that good to the consumer. In a free competitive market, the price is supposed to equal the marginal cost and the marginal benefit. If either the cost or the benefit from that good rises, it will result in a change of price. In such a case, the cost and benefit from that good are said to have been internalized in the price of that good.

The cost that is borne by the producer or the supplier of that good is the private cost of that good.

For example, if a producer employs capital and labor in a factory to produce that good, the payments made by it for that labor and capital will be the private costs. However, if the factory causes pollution of the air which causes asthma among local people living around the factory, the costs arising from asthma in terms of sickness and cost of treatment are costs that are not borne by the producer, but instead fall on third parties within the society. This is the social cost arising from the production of that good. The producer will be willing to produce the good if he can get a price that is equal to the marginal cost paid by him (his private cost), and will not be concerned about the costs falling upon other people. The social cost that is not internalized in the price is the Negative Externality of that good.

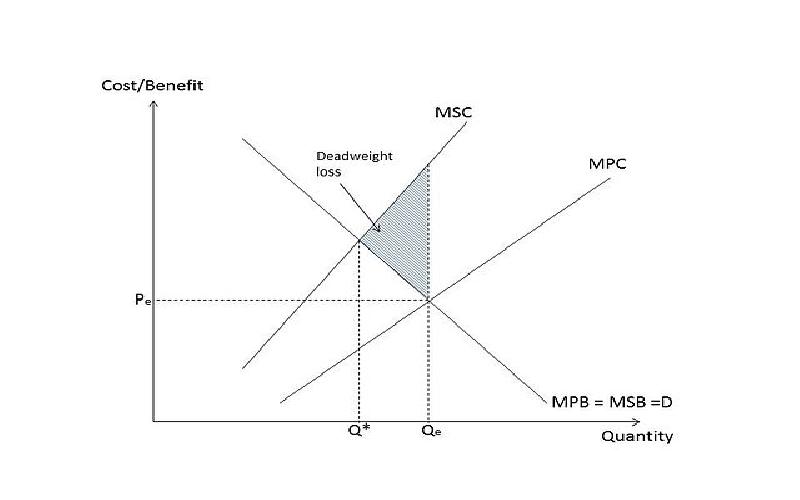

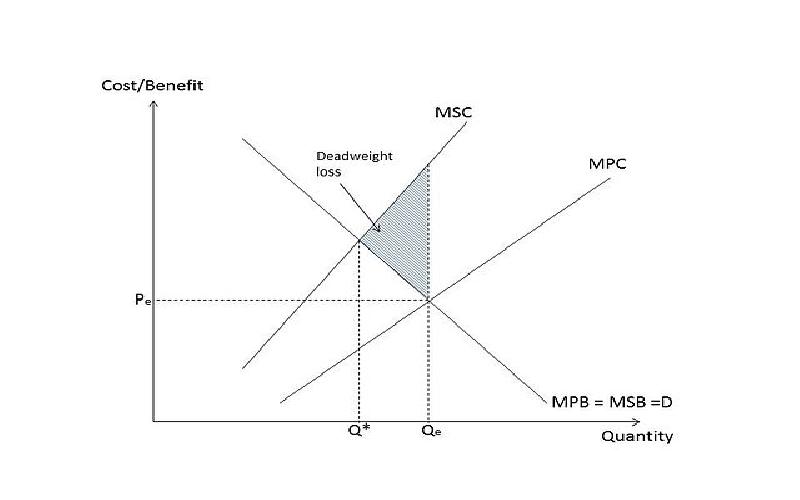

The production of a good is said to be efficient if the marginal benefit from a good is equal to the marginal cost of that good. This is because such a level of production maximizes the welfare of the producer and consumer. However, in case of a negative externality from social costs of pollution, the marginal benefit to the society from that good is less than the total marginal cost, if both the private and the social costs are taken into account. This is inefficient production because by producing the marginal good the society becomes worse off.

In case of a negative externality, the optimum production, at which marginal benefit equals marginal total cost will be lesser than what is achieved in a free market. In other words, markets produce more than what they should, in case of a negative externality.

The best way of tackling a negative externality is to artificially include the social cost in the cost of production, by taxing the producer an amount that is equal to the social cost of pollution. By increasing the private cost by an amount equal to social cost, the marginal benefit to the society from that good is equaled to the total marginal cost of that good to the society, which would be an efficient level of production.

A positive externality would be one where the production or consumption of a good leads to certain benefits for other people in the society. An example would be immunization by a vaccine. When a person is immunized against an infectious disease, it reduces the probability of that infectious disease spreading around, which in turn benefits the whole society. This is a case of positive externality, which is also not internalized in the price. The consumer would be willing to pay only to the extent she gets the benefit, and would not be willing to pay on account of social benefit. Hence, the price would reflect only the private benefits, and ignore the social benefits or the positive externality. The best way to deal with positive externality would be to provide a subsidy on vaccines.

Externalities: A Case for Government Intervention

Externalities cannot be taken care of by the market. They are examples of market failure, which needs to be corrected by government interventions. One way to deal with externalities is by way of taxes or subsidies. However, there could be other options too, in the form of non-tariff barriers consisting of Licenses, in case of negative externalities, which restrict the production of polluting industry to a limit that is optimum for the society.

Similar Read:

Importance of Managerial Economics in Decision Making

Trading on forex markets is by no means an easy task. Apart from being speculative and intuitive, traders need to be focused, disciplined and cautious about different forex scenarios.

Modern economists often make the blunder of ignoring the two precious forms of capital without which human societies can neither prosper, nor survive. One of them, the Environmental Capital is now being recognized as a depreciable asset that needs to be preserved or refurbished.

In order to become a very successful entrepreneur, you would need to have certain very important skills. These skills when applied in the right way can make you the best entrepreneur..