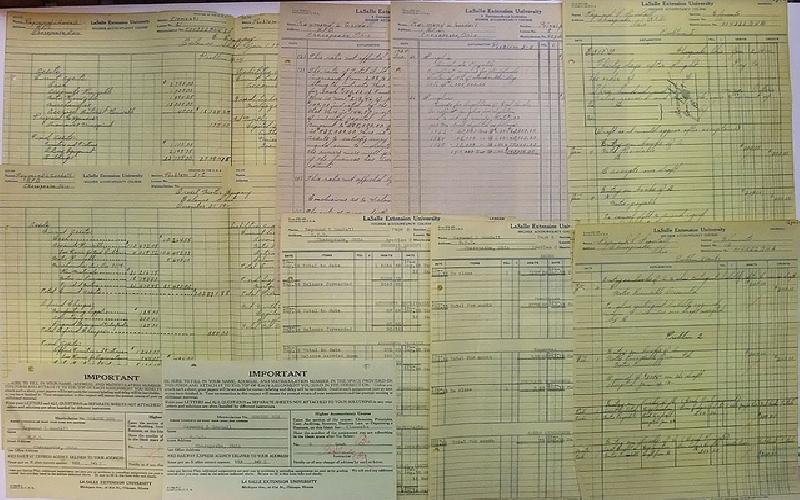

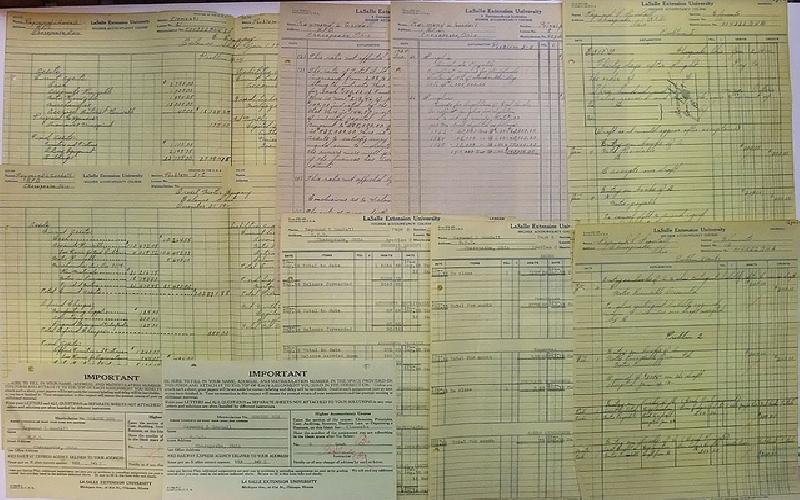

Accounting worksheet and its purpose

This article is about using the accounting worksheet in accounting process. It highlights the importance of using the accounting worksheet in all the functions of financial accounting.

A worksheet or sheet is a single page in a file created with an electronic spreadsheet program, such as, Microsoft Excel. Without further ado, it is good to know some facts about an excel worksheet. Excel 2003 worksheet has as many as 1,048,576 rows per worksheet while there are 16,384 columns per worksheet. It’s also interesting to know that the number of worksheets per file depends on the amount of memory available by the computer. It’s unlike the earlier versions of excel, in which the number of worksheets in one file was just three. However, there are a number of benefits extracted from using accounting worksheets while performing accounting tasks.

In this article, we would discuss about the purposes of using Microsoft Excel worksheets in accounting process.

Creating Chart of Accounts: Chart of Accounts is a starting point for setting up book keeping and accounting system of any type of business. It tells which accounts are to be included in general ledger and mechanism to be followed. Depending on the nature of account, each account is assigned a number. Precisely, the chart of account is a list of all the accounts to be used for double entry accounting system. In order that a well-developed standard chart of accounts be created, Microsoft Excel worksheet is of great use, as it helps to maintain account number, account description, accounts grouping and to provide account balance information.

Preparing Journals and Ledgers: Both Journals and ledgers can be prepared conveniently in Microsoft Excel, because the rows and columns are well-suited for creating and maintaining accounting journal and ledgers. The number of rows and columns can be selected and the formulas can be inserted according to the required ranges. It’s important to note that once the formulas are created for journal or ledger, you don’t need to type formulas again. You can simply copy and paste to the ranges that cover the data.

Adjusting Entries: One of the main purposes of an accounting worksheet is to record adjusting entries. They are generally made at the end of the accounting period. Adjusting entries are made for accruals and deferrals to match revenue and expenses. The use of adjusting journal entries is a key part of the period closing processing and in order to accomplish this part Microsoft excel worksheet is very much helpful, as these entries can be recorded successfully.

Trial Balance: The purpose of preparing trial balance can be efficiently accomplished by using worksheet. After adjusting entries are made, each and every account that is affected is updated and the balances are transferred to trial balance accordingly. A trial balance is a list and total of all the debit and credit accounts of a business for a given period. The format of the trial balance is generally a two-column schedule with all the debit balances listed in one column and all the credit balances listed in the other column. In this way, worksheet can be of great assistance to keep the ledgers in balance while it enables to prepare trial balance without involving much efforts or troubles.

Closing Entries: The closing entry is used to transfer data from the temporary accounts to the permanent balance sheet or income statement. The purpose of the closing entry is to bring the temporary journal account balances to zero for the next accounting period, which aids in keeping the accounts reconciled. Accounting books are closed at the end of each accounting year. Thus, worksheet aids greatly in closing process as well.

Financial Statements: Preparing financial statements requires an adjusted trial balance to translate into financial reports, such as, income statement and balance sheets. This involves transferring the balances to the appropriate balance sheet and income statement columns. In doing so, a worksheet can be of immense help and assistance to the accountants.

International trade requires taking into account the risks that are inherent in doing business across political boundaries. These include changes in political environment and the resultant impact on business viability, violence, conflicts, regulatory sanctions imposed by authorities and even cultural issues.

Professionals in all fields need to have good writing and communication skills of English language. Effective writing ability must be regarded as an asset to the person, as it leads to create value for him.

Commission or brokerage is percentage or an allowance that a person gets for doing his business. It may be related to selling or buying of goods etc.