To Prevent Large Unbearable Losses, We Opt for Small Affordable Losses

Most of us opt for insurance, but only few realize how it works, what its benefits are and how it helps in preserving our welfare. Such an important decision deserves better understanding. Moreover, the ability to take an informed decision is at the center of using the facility of insurance to one’s best advantage. To facilitate this awareness, here is a simple explanation of the economic theory of insurance.

Insurance has become a part and parcel of modern day financial planning, and has come to acquire an important place in the way we plan the security of our life standards and family. While every person may opt for it for different reasons, very few attempt to understand the phenomenon of insurance and how it makes them better off. Given its great significance in the way we plan our lives, having a proper understanding of insurance theory can help us in approaching this task with greater understanding and mental clarity.

To understand insurance, we must first understand the concept of risk.

Risk is constituted by the likelihood of an adverse event that can make us worse off and is likely to happen with a certain degree of probability. Risk is measured in terms of the adverse impact of such event in terms of that probability. For instance, if the loss from that adverse event is likely to result in a loss of $ 100 and the probability of the event is 10%, the measure of risk is $100 multiplied by 0.1 or $ 10.

Managing risk is an important challenge. To take care of a likely loss of $ 10, usually keeping the same amount aside would amount to sufficient preparation.

However, this does not work in cases where there is uncertainty about the adverse event happening or not happening. In our example, keeping aside $10 would not be enough, because if the adverse event does happen, it would lead to a loss of $100 and the $10 set aside will not be enough for covering it. On the other hand, the 90% probability that the adverse event may not happen at all means that there is no point in keeping $100 aside.

To address this problem, a solution can be found, if ten people facing the same risk come together and pool $10 each, thereby creating a pool of $ 100. Given the probability of 10%, only one of them is likely to face that adverse event, which can then easily be taken care of by the pooled amount of $100. By pooling risks and dedicated resources to deal with it, these ten people can be said to have insured themselves against the risks faced by them. This risk pooling by many people to create a resource for addressing their overall losses is the central concept of insurance.

An interesting fact about insurance is that people must contribute money to manage their risks. By contributing resources to the collective pool for addressing risks, they still suffer losses that are actually the same as the amount of risk which they are supposed to protect against. In the preceding example, to cover a risk of $10, a person has to spend an equal amount of $10. Now, if such contribution is to be made ten times in life and the probability of the adverse event is only once in a lifetime, then the total expenses for managing the risks of $100 is also an equivalent $100, which can make you wonder as to why anybody would be interested in protecting against a possible loss by incurring an equal loss. The answer to this riddle lies in welfare economics.

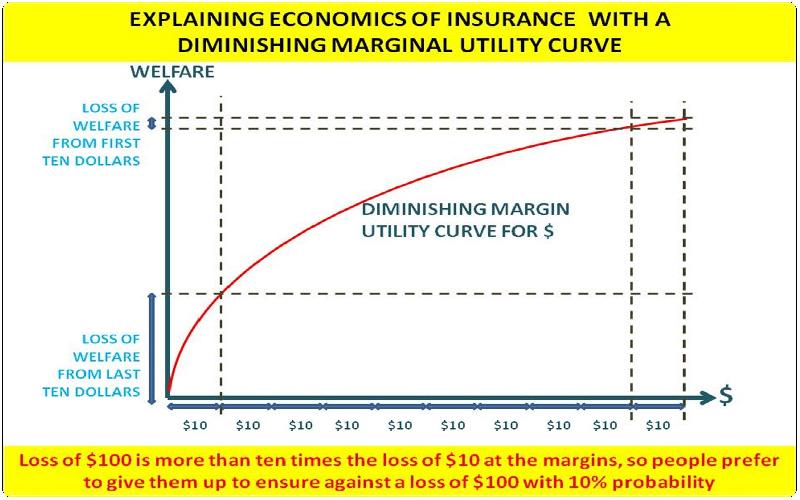

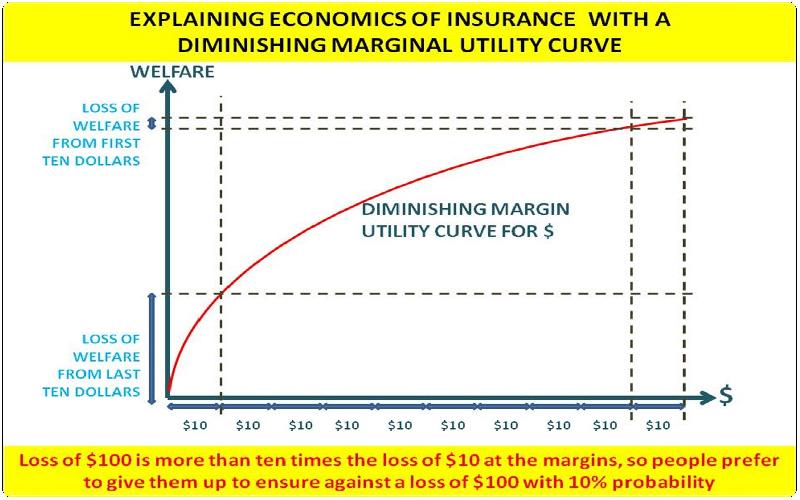

Even though the cost of addressing a risk of $10 is an equal amount of $10, yet most people prefer to bear this cost and get them insured against that risk. To understand their logic, one needs to dwell into one of the basic concepts of economics, known as the principle of diminishing utility. This principle explains that the first dollar that you have has a greater value than the next one, which in turn has a greater value than the next, and so on. If a person has a hundred dollars, and he gives up ten dollars, he becomes worse off. But losing another ten dollars will worsen him more than the earlier loss of ten dollars. Losing next ten would be even worse, and so on. Finally, when that person is left with only ten dollars, losing them will hurt him more than any of his earlier ten dollar losses, since that will leave him a complete destitute.

Thus, for a person having $100, losing all 100 is not ten times as bad as losing only 10. It is actually much worse – it could be fifteen times as bad, or maybe twenty, or may be even more! To understand it in a real life example, losing a part of your savings again and again can be really bad, but losing all your belongings, dwelling and livelihood together even once in a lifetime can be infinitely worse. This is why to prevent that much worse outcome, a person prefers to lose only that part of his resources, which he can easily afford, with relatively lesser loss of actual welfare.

Accordingly, since losing $100 would be more than ten times as bad as losing $10, a person may prefer to lose $10 and thereby insure himself against a loss of $100 with 10% probability. Even if he has to pay it ten times in life and get the benefit only once, yet, by insuring, a person becomes better off. This is why most people opt for insurance.

Insurance requires pooling of money, and this money needs to be actively managed till the time it can be used for countering the losses arising from adverse events. When the pool is very large, as happens in case of Insurance companies, the pooled resources are required to be managed on a regular basis. Another challenge that also involves costs is risk assessment. When several people come together to join a risk pool, the risk faced by each one of them may not be the same, neither may be the degree to which they wish to insure themselves. Estimating their respective risks, determining appropriate contributions for them and managing pooled resources, becomes an enterprise in itself, requiring manpower and offices. The people and the offices that run insurance are the cost of insurance, which must also be borne by people who are insuring themselves.

In addition, there could be other costs as well. An insurance company may need to invest money in assets to preserve it from inflationary losses, but the process may still lead to losses. For example, if the insurance company invests money at 5% interest, but inflation rate is 10%, the money will depreciate by 5%. If money is invested in a business, which gets bankrupt, that money can also be lost. These are risks faced by insurance companies, which again need to be managed actively by proper risk management strategies. How insurance companies manage their resources can have a significant bearing on their capacity to fulfill their insurance obligations.

Opting for insurance is a rational and economically effective way of managing risks in life. However, what one needs to take into account is the probability of the risky event that one is trying to insure against. In the preceding example that we discussed, it is possible that every one of the ten persons facing a risk may not have the same probability. For someone, it could be only 5%, whereas for another, it could be 20%. Now, if everybody has to contribute the same amount of $10, the person facing 5% risk will be paying more compared to the person facing 20% risk. This does not necessarily mean that the person facing 5% risk should not opt for it. It is more a question of realizing what one is paying for and taking an informed decision.

One can follow some basic rules which can make decision making easier. Generally, insurance is most useful against an even that is bad enough to completely upset your life and financial plans. Thus, life insurance is often preferable to preserve the financial welfare of your dependents. Similarly, fire insurance of your dwelling would be preferable to insure against unforeseen losses. Health insurance against serious ailments with large financial implications is also worth considering. On the other hand, insurance against minor losses may not be worth the effort. As a thumb rule, the more debilitating the adverse effect, the more rational is the decision to insure against it. The lower the probability of such an event, the lesser would be the cost of insuring oneself against it, making it even more preferable.

A well informed timely decision on insurance could turn out to be wisest of your actions in bad times!

The modern human beings are so engrossed in economic activities that the human species can now be named as Homo Sapiens Economicus. In this economic universe, Governments have a huge responsibility to regulate economic activities of the people in a way that maximizes the welfare of the people.

Economics can be understood as a study of how, when and why economic agents indulge in economic actions in respect of economic goods. Economic goods, by definition, are those goods and services that make a human being better off.

Health insurance is an essential plan to be adopted these days. But a large population is not aware of the benefits of health insurance.