What are the benefits of breakeven analysis?

Breakeven analysis is considered as an essential tool in every business prospect. The below article is about break even analysis. It discusses the benefits of making break even analysis in business.

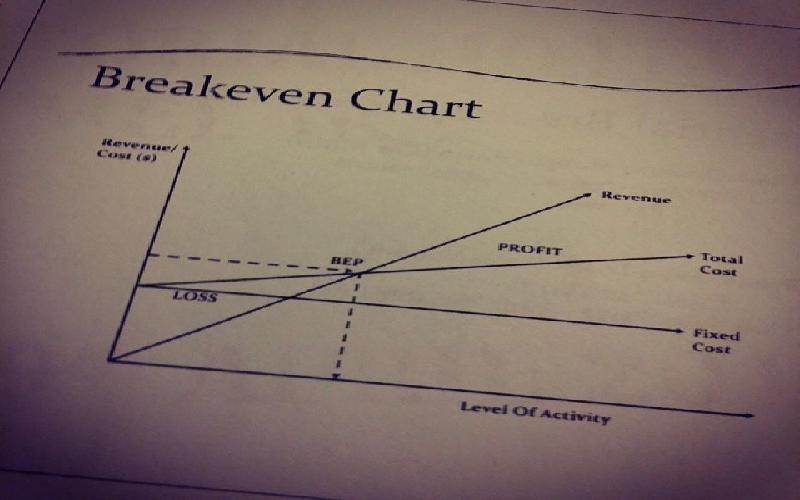

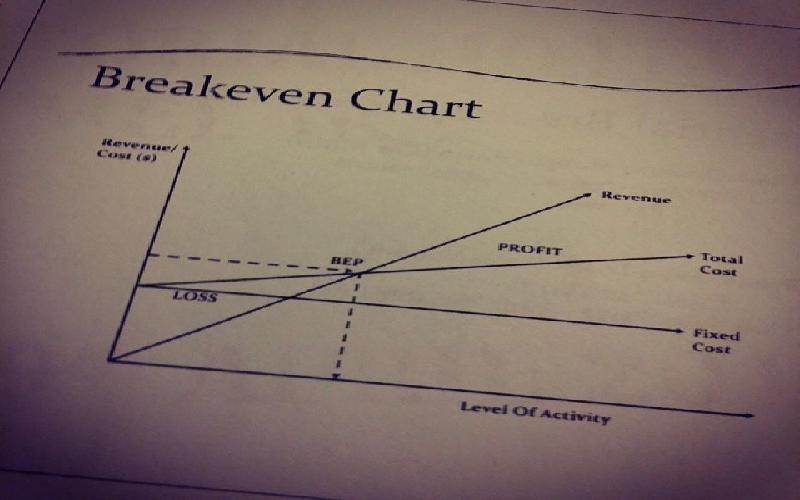

The break even analysis is one of the useful tools in the hands of a business management. It’s important to know the breakeven point when there is a need of evaluating various business plans or business projects. It is much applicable when there are business expansion grants. Breakeven analysis is an effective and helpful technique to be used when business expansion loans are applied as well. The breakeven point is where the investment can generate positive returns. The breakeven point calculation is done on the basis of simple mathematics and this can be presented with breakeven analysis graph.

The breakeven point analysis shows the relationship between variable costs, fixed costs and the returns on an investment. A break-even analysis involves a simple computation through which it evaluates the level of production at a given price, while break even point analysis discloses whether the intended project seems to be feasible to cover all the costs or not.

One of the extremely important benefits of applying break even analysis formula is to evaluate the practicability of various business projects that a business management is willing to undertake.

Breakeven analysis is very much useful in capital budgeting, as it evaluates the viability of various business projects providing necessary information through which it may be determined whether the business project or projects that are to be selected, are capable to generate positive returns in the future or not.

In making breakeven analysis, business management will prefer the contribution approach to the income statement rather than using regular income statement template. In other words, profit and loss statement will not be used as it is used in general, because the regular format does not provide the necessary information of variable costs on income statement, whereas the Contribution Income Statement highlights the changes in fixed cost and variable costs that affect the level of cash inflows or profits. In this way, contribution margin income statement template is very much useful. Thus, breakeven analysis is an effective tool to make a successful business plan. It shows how to start a business while it helps in determining the ways to grow your business by generating profits and preventing losses.

This article includes the basic financial economics an individual faces on a daily basis, irrespective of the country he or she is living in. The sooner this knowledge is learned and shared, the better for you..

Speculation in financial assets and transactions is always a game full of risk. The reason why financial analysts who ought to know this better than us, still indulge in such risky games, is because of the asymmetry in profits and loss sharing.

Finance is much concerned with the effective utilization of funds. It’s focused on the arrangement of funds at the right time in order that the determined tasks may be carried out satisfactorily.