Rationality of Expectations does not fit in the Economic Theory of Asset Markets

Rational expectations theory has been the pillar on which most economic research has been carried out during the last few decades. It is a concept that practically reduced human behavior to mathematical equations and statistical figures. However, the general inability of this theory to explain business cycles and its spectacular failure in explaining asset market fluctuations seem to have discredited it in an irreversible manner. Is this basic principle which guided economists for over half a century, finally dead?

Around half a century ago, introduction of a new theory practically changed the way economists look at real world problems, and also brought radical changes in the way economic research is undertaken. Ever since John F. Muth came up with his famous articulation of the rational expectations theory in 1961, the world of economics has never been the same again. It was the underlying rationality of expectations, which laid down the presumption of predictable behavior of all economic agents, and in turn led to the flooding of economic research by statistical methods, such as multivariate regression.

Muth conceived people as rational economic agents, who act to maximize their own welfare, and their expectations actually reflect the equilibrium status achieved by the economy. This is how he explained it:

“I should like to suggest that expectations, since they are informed predictions of future events, are essentially the same as the predictions of the relevant economic theory. At the risk of confusing this purely descriptive hypothesis with a pronouncement as to what firms ought to do, we call such expectations rational.”

What Muth effectively said was that the expectations of the masses are always coincidental with the market equilibrium, and so they can never be irrational.

This has huge implications, because if expectations are always coincidental with the market forces of supply and demand, then markets as well as expectations are never irrational and will always behave predictably. Even the overall rationality is ascribed to the overall expectations and not necessarily to an individual, the economic implications remain the same, since it make the market movements and prices invariably rational.

After Muth, major development of his hypothesis was undertaken by Robert Lucas (1972), who applied the concept to monetary expectations. The role of expectations was then combined with the concept of market equilibrium which had been introduced in 1954, prior to the work of Muth by Kenneth Arrow and Gerard Debreu, who showed equilibriums to form in competitive economy. The rational expectations hypothesis assumes that people as rational agents have expectations that are consistent with the stable equilibrium. As per this hypothesis, any error of such expectations from the equilibrium state is immediately taken note of by other agents, who rush to cash on the arbitrage opportunity in such a way that such errors are immediately corrected, without any significant lags, and with insignificant costs.

The greatest impact of rational expectations theory was on the way economic research was conducted. It laid the foundation for taking the human behavior as that of a machine, that can be expressed in mathematical terms – a phenomenon that allowed the growth of multiple regression and econometric analysis as the most favored method of empirical research and simple, often linear mathematical equations with multiple simplistic assumptions as the most favored way of theoretical analysis of human economic behavior. Based on the presumption that expectations are always rational, these statistical results were often cited as empirical evidence, which became the latest buzzword in economic research.

Long before Muth, Alfred Marshall (1879) had suggested a relationship of expectations with business cycles. To a large extent, during the half a century of our experience with rational expectation theory, this theory has spectacularly failed to explain business cycles. In spite of this, it continued to be the most favored one among the economic community for one simple reason – it provided great convenience to economic researchers by allowing them to convert all human behavior to mathematical and statistical equations and figures. The use of statistics and figures, often base of innumerable assumptions in addition to the rational expectations theory, created an illusion of evidence that was actually little more than self-hypnotic in nature, and often enabled the economists to claim that economics was more of a basic science than a social one.

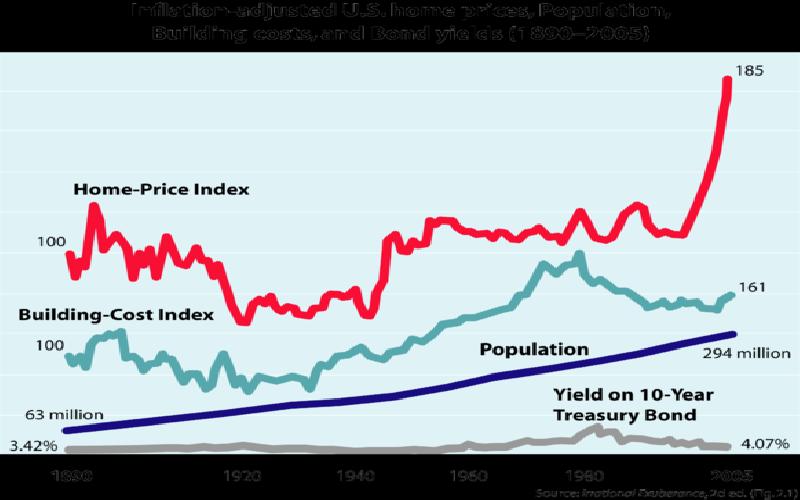

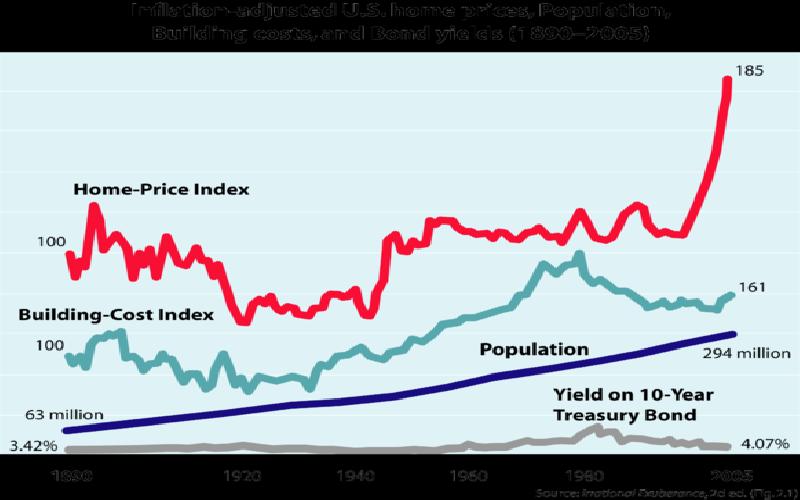

The challenge that actually exposed the limitations of rational expectations theory was asset market dynamics. As the equity stock market began to grab everyone’s attention, as more and more commodities began to be traded as assets, and most importantly, as house prices peaked and then fell creating one crisis after another, new terms begun to be used in daily conversations. Asset bubble and bust were two of them. Massive fluctuations in equity market soon became an anti-thesis of the rational expectations theory. Massive raises in commodity and housing prices similarly contradicted the supposed rationality of human expectations. The inability of rational expectations theory to explain the asset markets began to pose question marks on its validity. It showed that the presumption of rationality of all economic agents was a too farfetched and cannot be taken for granted.

Many great minds have highlighted this fallacy long back. Herbert Simon, who was awarded the Nobel Prize in Economics for his works, pointed out in no uncertain terms that human decisions are made not on the basis of detailed and complex calculations, but in a heuristic manner, utilizing thumb rules learnt from past experience, and using signals from wherever they may become available. He also pointed out that expectations of investors in an asset market are largely the expectation of how others are likely to behave, and since such expectations make them act, it can often be in the form of a self-fulfilling prophecy.

When the investors expect that the market will fall, they begin to sell their holdings, which bring down the price. On the contrary when they expect market to rise, they buy, thereby fulfilling their own expectations. Asset bubbles and busts are unsustainable states of asset market that are bound to end in crisis and panic. The fact they cannot be explained without giving up the rational expectations theory, is the single reason why economists have not been able to unravel its mystery. They represent a form of human behavior that is not convertible into figures and statistics. The failure of rational expectation theory in dealing with asset bubbles can mark the death nail for this economic theory, which has been at the center of all economic deliberations in the last six decades.

Does it mean that expectations need not be rational? Perhaps, it would be more accurate to say that given the limitations of human decision making and the self fulfilling nature of their expectations, expectations cannot be presumed to be always rational. This is particularly true of asset markets.

Actually, the expectations generally tend to approximate rationality, not because of the fact that human expectations are inherently rational, but because irrational expectations are usually unsustainable. When somebody has an irrational expectation, it does not get fulfilled, and so his experience forces him to correct the fallacies of his expectations. In a usual market for consumer goods, this correction happens expediently enough to ensure rationality of expectations. The same, however, is not true of asset markets, where expectations can be self fulfilling and expectation driven bubbles and busts can sustain for a reasonable period of time.

To conclude, rationality of expectations is not a cause of market equilibrium, as the rational expectations theory suggests, but instead, an effect of the market equilibrium. Thus, the degree of sustenance of rationality in expectations depends on how quickly the market can punish irrational expectations and endures rational one. In consumer markets, where expectations do not extend much into future, this correction is much faster, and hence the presumption of rationality can be sustained to a greater extent. In asset markets, where the expectations extend long into future, they often have the tendency to acquire a self fulfilling nature, thereby becoming a breeding ground for irrational expectations. This is why rational expectations theory becomes more or less inapplicable in asset markets.

The world of economists is still struggling with this inability of rational expectations theory. In the same way they are also struggling with asset bubbles and busts. Perhaps the rational expectation theory is still not dead, but it has certainly lost its relevance as far as the asset markets are concerned.

Most of the features of UITF were already discussed under Pooled and Mutual funds. What I want you to know more is the difference between the types of pooled funds.

This article describes the technical and operational feasibility. It also discusses the importance of technical and operational feasibility in the system development process..

Commission or brokerage is percentage or an allowance that a person gets for doing his business. It may be related to selling or buying of goods etc.