Create your own Personal Monthly Budget Template on Excel

Excel templates to plan your budget is wise because Excel calculates your budget for you and you will have a personal template that can be updated monthly. When changes are made Excel automatically recalculates your totals on your spreadsheet so that it does all the hard work and all you do is save your new budget template.

First you will need a computer or laptop with Excel software. You can download it or use Google Docs as an alternative to create your Budget, but we will assume Excel for this tutorial. Go to Excel and open a blank page to create a new spreadsheet template by clicking on "new blank workbook". Label your Months or Weeks across the top of the columns starting with Column B. Use Column A to Label your categories of incoming and outgoing expenditures.

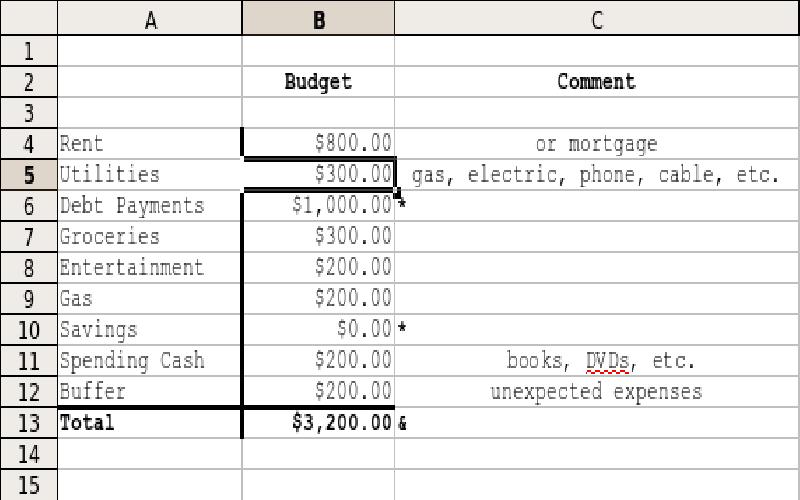

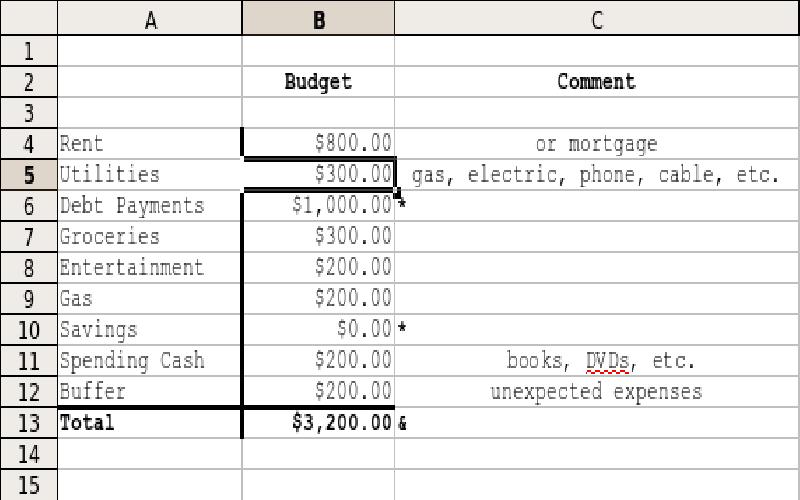

Start by labeling two main categories for your left column of your spreadsheet: Income and Expenses. Then list subcategories for each.

Start with Income and use two subcategories: Fixed Income and Variable Income.

List Expenses as your second main category down the left column on your Excel template. Divide your Expenses category into three sub-categories: Fixed Expenses, Variable Expenses and Periodic Expenses.

Adding formulas on Excel can seem complex but there is only one main formula that we will need to help calculate our budget spreadsheets. This formula is called AutoSum. AutoSum adds data together represented by corresponding line numbers. Here are the basic steps:

To check how much you earn verses what you spend, there is another simple formula you can use. Assuming your total income is represented in box 7 and total expenses in box 19 for example, use this formula =SUM(B7-B19) to subtract the two.

Place this box at the bottom of your other calculations and label Balance to represent this total which could be positive or negative - hopefully positive but if it's negative it indicates adjustments will need to be made.

One of the most important aspect of creating a budget whether you use Excel, or another spreadsheet program is to use it as a tool to adjust your spending and habits and make cuts or additions where necessary.

Finally, once you have made all your adjustments and you are happy with your outcome you can simply name your Excel budget template and save it. Make sure to revisit your spreadsheet often to accurately include any expenses and income adjustments when needed and you will then have a tool that can help you change habits and keep you in budget.

Additional Tips and Tricks:

Group variable forms of income that you aren't able to estimate as Reserve Funds category. Try not to include them if not absolutely necessary or at least estimate these amounts on the low side if you do include them in your budget.

Also, It is sometimes a good idea to list Other as a category under income or expenses to allow any sudden unexpected changes that cant be grouped and wont fall into a category every month.

Leave travel allowance is an allowance paid by employer to employee for the purpose of traveling within India. The major benefit of Leave Travel Allowances ( LTA ) is that they are exempt from tax.

Buying property whether it is a house or a block of land is not as easy as one may think. In reality, location of the property and the price do matter.

Microeconomics and macroeconomics constitute the fundamental divisions of economics, each addressing different tiers of economic operations. While certain principles are shared, they center on discrete levels of examination, leading to diverse consequences for decision-making and policy formulation..