Chinese Currency, US trade deficit, Zero Fed Rate or Greed of Financial Executives?

Mortgage Mess was the most visible part of the Sub-Prime Crisis that rocked the global economy in 2007. However, just like the tip of the Iceberg, there were many other factors and imbalances that led to its creation and existence. At the core of the crisis was the real estate bubble that sustained the unsustainable for a few years, before the inevitable happened. Even more important, perhaps, were the underlying global imbalances that led to it.

The twentieth century began with some degree of economic uncertainties and turbulence in the wake of dot com bubble, wherein the average price earnings ratio of dot com companies reached an unprecedented level of 200, which was almost two and a half times that of the level recorded during the peak of the Japanese real estate bubble in late 1980s. As happens with all asset bubbles, the dot com bubble had gone bust by 2002, resulting in market capitalization losses approximating five trillion dollars. One of the contributors to the dot com bubble was the Taxpayer Relief Act of 1997, which significantly reduced the capital gains tax on equity in United States and thereby created new incentives for investing in assets such as equity and real estate.

The next five years after 2002 looked like a dream run for the economy, as the global economy, following the US economy on its heals grew at a rapid pace, even while inflation and interest rates reached near zero levels. The fact that this happened in spite of the United States experiencing unprecedented current account deficits practically turned the whole macroeconomic theory upside down, as researchers around the world scratched their head in vain trying to make out what was going on. It seemed like an unending age of prosperity that had descended upon the global economy, before all of a sudden, the whole economic edifice came crashing down in 2007, resulting in one of the worst economic nightmares of the recent times. The aftereffects of the subprime crisis which precipitated the global recession were felt for almost a decade thereafter.

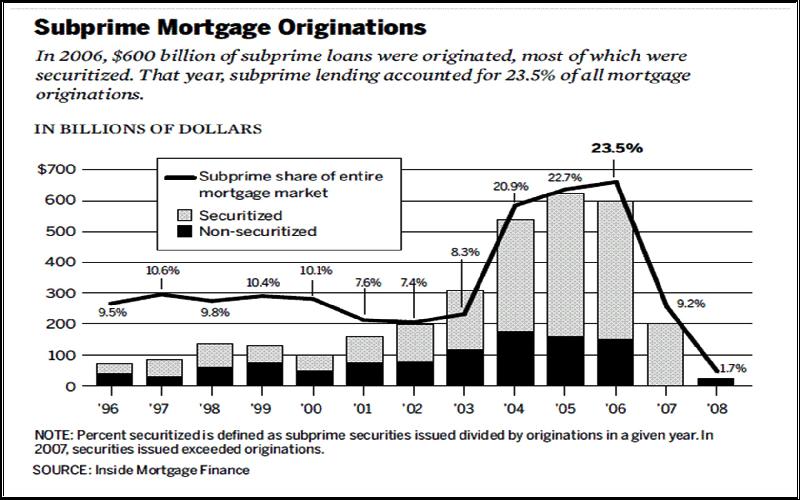

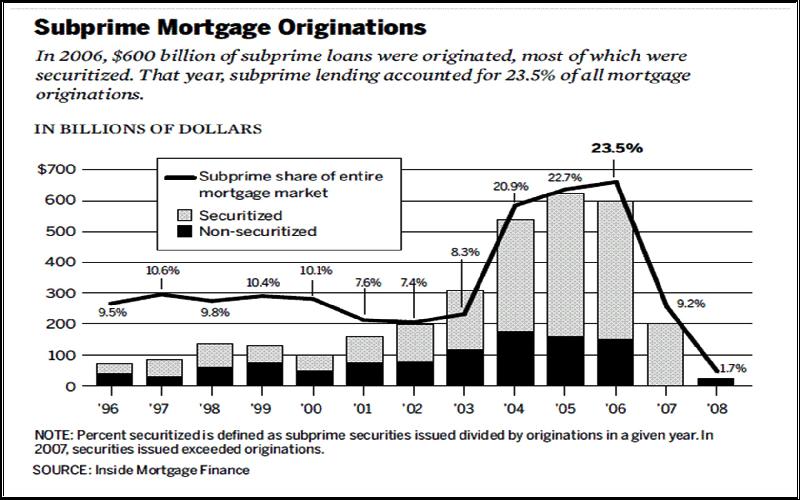

Central to this debris of the global economic fall-out was the mortgage mess that gave rise to the subprime crisis in the United States.

The subprime buyers, who had taken mortgage loans for buying real estate in the hope of a shortcut to riches, began defaulting once the asset bubble in real estate crashed. Everything else came down with it crashing.

The blame for the mortgage mess during the Sub-prime crisis has been directed by people and the media largely at the greed of the financial executives who created opaque financial instruments to hide the subprime nature of mortgages extended by them to candidates with less than acceptable credit ratings. The Fed, with its artificially low Fed Rate has also been blamed by the Academicians, and not without reason, for setting the stage for an asset bubble that burst with the crisis. However, there were other factors that lay at the root of all these events and some of them seem to have largely been ignored during the analysis of the crisis and its causes.

Amazing as it may seem, the roots of the mortgage mess and the sub-prime crisis and recession that it led to, lied in the global imbalance created by two simultaneous happenings. The first of these was an over-zealous Chinese government that was indirectly forcing its own citizens to save, by maintaining a devalued currency for the sake of strategic accumulation of foreign exchange reserves by an ever increasing trade surplus with the rest of world, especially United States. The second reason, which was actually a counterpart of the first, was the increasing consumerism of US citizens in the wake of easy availability of Chinese goods that were significantly under priced due to the artificial undervaluation of its currency.

These basic imbalances eventually led to a cascading chain of events that began with undervalued Chinese currency and resulted in the sub-prime mortgage crisis. The large trade surplus of China since 2002 led to an increasing supply of dollars in Chinese foreign currency markets that should have put a very strong upward pressure on its currency. However, it was countered very effectively by the Chinese Central Bank, which, in the process was forced to make excessive purchases of US dollars. This, in turn, led to two major developments - a staggering accumulation of US dollars reserve in the Chinese Central Bank, and an oversupply of Chinese currency in its domestic economy, which was countered partly by sterilization, and partly by regulating liquidity with an iron glove through window guidance.

The bigger problem was the accumulating reserve of US dollars. Chinese Central Bank needs to do something with these dollars that it was accumulating. So, it decided to invest them in the safest asset on the planet, the US treasuries, thereby increasing their demand, jacking up their price, reducing their yield, and forcing investors in United States to move to other riskier assets, which in turn caused a rise in the demand of those other assets, and consequently a rise in their valuation. Unlike treasuries, which offer a more or less fixed internal rate of return, other assets like real estate are far more vulnerable to speculative valuations. This, along with the extremely low Fed rate, became a breeding ground for the asset bubble, which finally led to the sub-prime crisis.

The assets in the United States which got overvalued in this process belonged to two major categories, equity and real estate. While equity can be created artificially and thus is more adept in keeping pace with the rise in its demand, real estate supply is slow to adjust. Thus, though the rise in demand on equity also led to a major bullish trend, the impact on real estate was much stronger, even if a bit delayed, and once it gathered steam, the resultant speculative investment quickly percolated to the retail individual investor. It is usually at this stage that most asset bubbles burst, as large number of small investors get involved and then suffer once prices begin to fall. This bubble was no exemption either, as people with poor credit ratings began to invest in hordes to bring the real asset bubble to its peak, and then, when the bubble burst, departed when the prices began to fall. It was the defaulting subprime investor which precipitated the big bust, and that is how the crisis came to be known as ‘subprime crisis’.

Most researchers lay the blame of this crisis on the doors of financial institutions, for extending loans to subprime candidates who would generally not be considered creditable enough for an assured loan repayment, given their inadequate earning and repayment capacity. The financial institutions justified such lending by creating innovative opaque instruments that pooled the risks arising from such risky borrowers and mixed them together to create an impression of safety. All seemed great for a while, before their fallacies were exposed by a real crisis.

When a risky loan is mixed with another risky loan, it does not reduce the overall risk. It can help in case of an occasional default, but not when the whole system comes down. In this case, it was the whole system that came down due to the burst of the real estate asset bubble. The eagerness of financial executives was in turn incentivized by the inflated margin between the universal interest rate which had come down to less than a percent thanks to successive rate reductions by the Fed, and the almost five percent mortgage rate that the borrowers were willing to pay. Economic theory tells us that a retail interest rate is made up of three major components - universal interest rate, transactions costs and risks premium. The inflated margins in this case represented a high risk premium, and were the underlying reason for the financial executives opting for risky lending to subprime candidates. Since more money was there to make, a riskier preposition was justified. The riskier preposition in this case was the subprime borrower.

One can argue that the blame should be placed on lack of prudence of financial institutions, but in reality they were also guided by the trends, which suggested that the valuations will only keep rising. All businesses want to cash on opportunity, and financial executives were no exception. When they saw the demand for mortgages and the wide margin that was theirs to take in the wake of wide margin between prevalent mortgage rate and the Fed rate, they had to find a way to increase their client base. They did that welcoming sub-prime clients and used risk pooling to create opaque financial instruments to hedge their risks.

What these financial executives forgot, however, was that they were only distributing and sharing risks and by distributing them widely throughout the economy, they only extended the risk to the whole of the economy. An even greater mistake that they made was in not taking cognizance of the asset bubble in the real estate market, which was rising at a rate that was unsustainable making asset bubble bust inevitable, sooner or later. But then, this was a mistake that was shared by almost everyone around them, from the Fed to the Governments and large corporate players.

Financial Executives deserve to be blamed for the mortgage mess that engulfed the whole global economy soon afterwards. But while doing so, one must not ignore the whole cascade of events. Real estate bubbles have a notorious tendency to recur once every two decades, typically coinciding with the fading of public memory. Keeping the memories alive, thus, might help in preventing the next disaster.

There is another issue related to this whole episode that has never been discussed. Financial Executives were blamed for their greed, but then in our modern markets, can greed ever be separated from entrepreneurship?

There are a lot of benefits of preparing the income statement in a business entity. It gives a clear picture of a business pertaining to its profits and losses.

This article speaks about management accounting. It discusses the scope of management while it stresses the importance of management accounting in business organizations..

Effective system of maintaining employee records has its own value and importance in business organizations. It helps a business management in various ways.