Eligibility Criteria for receiving Social Security Survivor Benefits in United States

Social Security Benefits are an important component of social welfare. Their availability can provide significant relief to the individual or the family in times of distress. It is important therefore to be aware of your eligibility for the benefits, the procedure required to be followed to avail of them, the necessary information and authority whom one should approach.

Social Security survivor benefits are available to certain family members of a deceased person who was eligible for receiving social security benefits. Such eligibility is based on working history. The deceased must have sufficient earning credits or QUARTERS in which he/she earned the minimum prescribed amount.

For receiving social security benefits one generally needs to have 40 credits or quarters. In 2017, a person earns one credit for each $1300 in earning, up to maximum of four credits every year. In case of such a person, the family members will be eligible to receive the Social security survivor benefits. Family members of a person who died young can be eligible for the survivor benefits even with fewer credits.

However, the eligible person needs to make an application to the local Social Security Administration office with all documentation to claim these benefits.

Family Members who are Eligible for Survivor Benefits

The following family members are eligible to receive the Social Security survivor benefits.

(i) WIDOW / WIDOWER are eligible for full retirement benefits of the deceased on attaining full retirement age. They are also eligible for reduced benefits as early as age 60.A disabled widow/widower may receive benefits as early as age 50.

(ii) WIDOW / WIDOWER at any age if he or she takes care of the child of the deceased under the age 16 or disabled, who receives Social Security benefits.

(iii) UNMARRIED CHILDREN under 18, or up to age 19 if they are attending elementary or secondary school (high school) full time. A child can receive benefits at any age if he or she was disabled before age 22 and remains disabled. Under certain circumstances, benefits can also be paid to stepchildren, grandchildren or adopted children.

(IV) DEPENDENT PARENT of 62 years or older, under certain circumstances.

Application for Social Security Survivor Benefits

Social Security survivor benefits are provided only when you apply for it. Hence, if you qualify for receiving Social Security survivor benefits, you can call the local Social Security Administration (SSA) office to schedule an appointment, and subsequently visit in person and submit your application. Alternatively, you can also apply by mail or online at www.ssa.gov . It is worth remembering that Social Security Survivor benefits are paid only from time one applies for them and not from the time of the death of the deceased. So a delay in filing your application amounts to forfeiting of benefits for the time of delay.

Following documents are required to be submitted to the SSA for making the an application for Social Security Survivor benefits:

(i) Death Certificate for the Deceased

(ii) Social Security Numbers of the deceased and the eligible survivor

(iii) Birth Certificate of the eligible survivor

(iv) Marriage Certificate if the eligible is a widow or widower

(v) Divorce Papers if the eligible survivor is applying as a divorced widow or widower

(vi) Dependent children’s Social Security Numbers if available and Birth Certificates

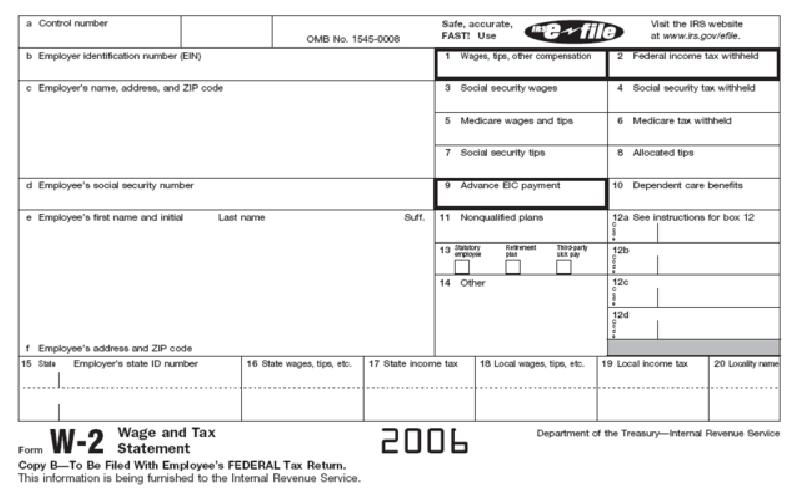

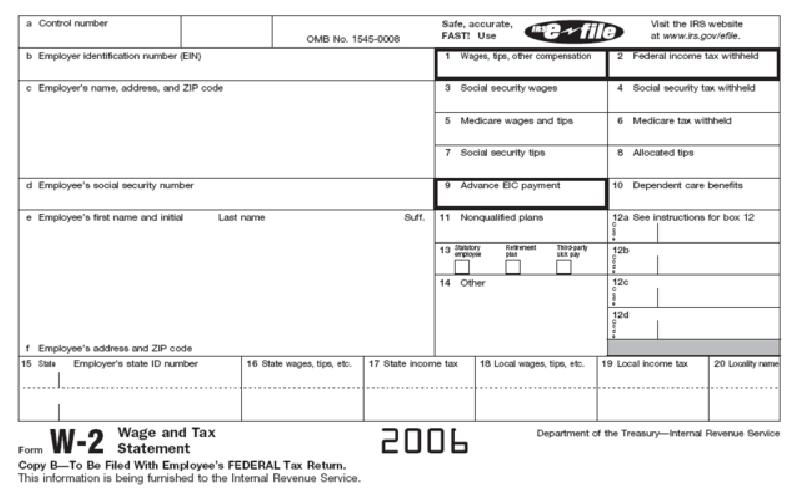

(vii) Deceased worker’s W-2 forms or federal self employment tax return for the most recent year

(viii) Proof of U.S. Citizenship or lawful immigration status (for a person not born in the U.S.) and Military Discharge Papers (if the person had military service) may be required if the survivor does not have a Social Security number

(ix) Name of your Bank & Bank Account Number

Once you have made the application, SSA will take its own time to process and act upon it, so you need to be patient while awaiting your benefits.

Most of the features of UITF were already discussed under Pooled and Mutual funds. What I want you to know more is the difference between the types of pooled funds.

Ordinary interest is calculated on the basis of a 360-day year or a 30-day month; exact interest is calculated on a 365-day year. The interest formulas for both ordinary and exact interest are actually the same, with time slightly differing when given as number of days..

Business life is stressful. Therefore organizations have realized the impact of stress on work and yet have taken an initiative to counsel the business employees to improve the work efficiency by promoting stress free life..